827 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

hpatner (Guest) says on The Tech Trader Wall...

Thanks.

What does BOT! mean?

What does BOT! mean?

pftq (Official) says on The Tech Trader Wall...

The orange BOT signals mean Tech Trader sees it as potential V-shaped bottom. The red ones are longer term, meaning it may just flatten out but is essentially where Tech Trader thinks is a floor for the stock. Note that it doesn't mean it necessarily gets traded, just part of Tech Trader's thought process amongst many other things it draws on the charts.

pftq (Official) says on The Tech Trader Wall...

Large 1M share buy on $MNST that just pushed the price a couple dollars. Similar trade on it last week as well.

815 unique view(s)

April 18th, 2016

rppp (Guest) says on The Tech Trader Wall...

Funny the news that moved it was potential talks with LabCorp …

R--

R--

846 unique view(s)

April 15th, 2016

pftq (Official) says on The Tech Trader Wall...

Taking gains on many energy names into week end. Main one holding is $PBR, ironically most tied to Brazil impeachment situation. The timing is pretty amazing as this is basically Tech Trader reducing exposure before the vote on Sunday.

pftq (Official) says on The Tech Trader Wall...

Here is the news on Brazil and $PBR for those who aren't following as closely. Again, pretty amazing that we're taking gains off the table right into the vote on Sunday while keeping the one name literally in the center of the impeachment scandal.

http://www.wsj.com/articles/rousseff-asks-brazil-supreme-court-to-suspend-impeachment-process-1460664902

http://www.wsj.com/articles/rousseff-asks-brazil-supreme-court-to-suspend-impeachment-process-1460664902

842 unique view(s)

April 13th, 2016

852 unique view(s)

April 12th, 2016

pftq (Official) says on The Tech Trader Wall...

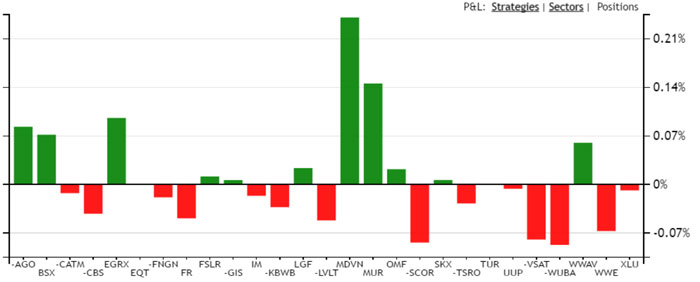

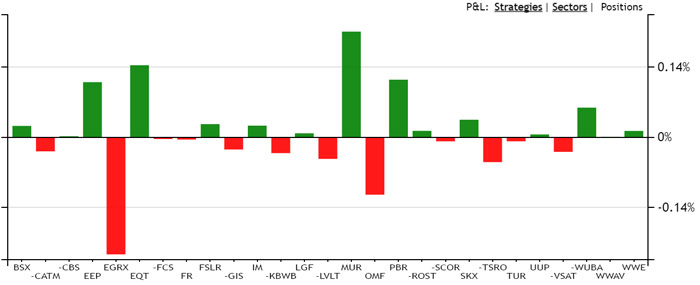

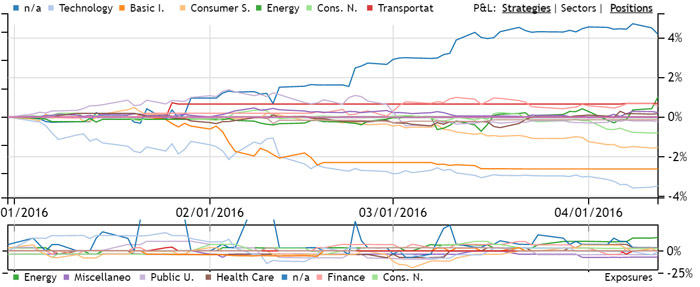

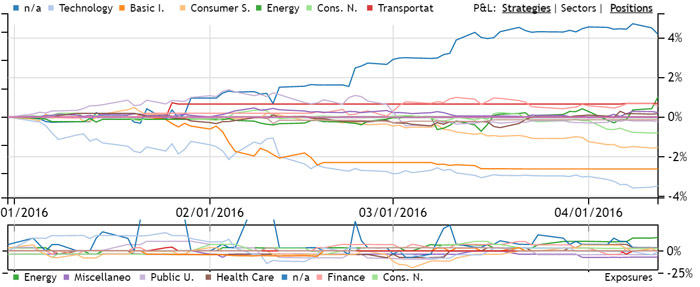

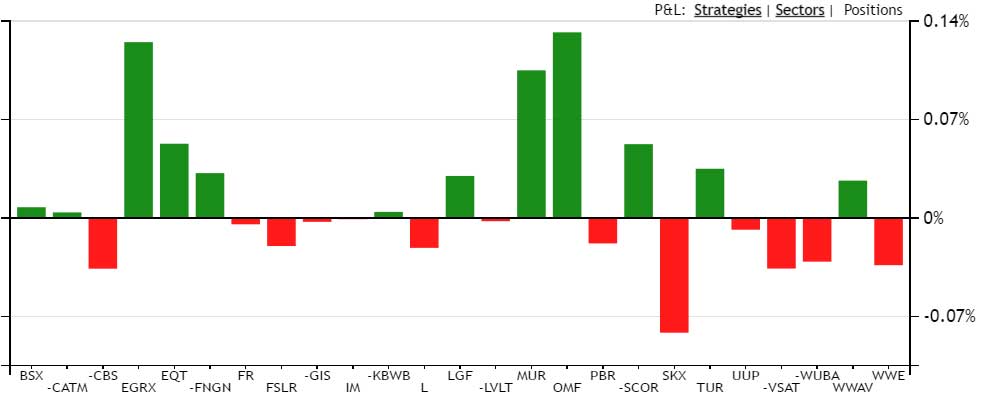

Adding to last month's long Brazil/Oil theme with $VALE to the existing $PBR, $MUR, $EEP, $EQT. Tech Trader is still overall very neutral in exposure (55% long, 40% short), but it'll be interesting to see if this starts to change and especially if it's via energy bets. You can see in the sector exposure chart at the bottom that Energy is now leading for both most exposure (still a modest 20%) and marginally the most P&L for the year (excluding ETFs).

pftq (Official) says on The Tech Trader Wall...

twgarry (Guest) says on The Tech Trader Wall...

Totally agree. Great work!

Sent from my iPhone

>

Sent from my iPhone

>

898 unique view(s)

April 6th, 2016

920 unique view(s)

April 4th, 2016

pftq (Official) says on The Tech Trader Wall...

$WWE, which had a bullish risk reversal on April 18x calls/puts last week, is in rumors to have a buyout offer. This is the options activity from last week:

WWE 4/15/2016 18x Calls, 1655@$0.8999

MV: $0.1M | $Not.: $1.4M | OI: 1094 | 8.6% TotalOI

22.8% StockVolume | 27.3% OptionVolume

Leg: WWE 4/15/2016 18x Puts, 1655 on OI of 2516

WWE 4/15/2016 18x Calls, 1655@$0.8999

MV: $0.1M | $Not.: $1.4M | OI: 1094 | 8.6% TotalOI

22.8% StockVolume | 27.3% OptionVolume

Leg: WWE 4/15/2016 18x Puts, 1655 on OI of 2516

950 unique view(s)

April 1st, 2016

pftq (Official) says on The Tech Trader Wall...

$OMF, which had Apr 31x call buying, just sold 47% stake in SpringCastle. See if this is the news the buyer wanted.

pftq (Official) says on The Tech Trader Wall...

Already out of $XLB at $45. Again, intraday swings so extreme this year that Tech Trader is daytrading these moves.

926 unique view(s)

March 31st, 2016

pftq (Official) says on The Tech Trader Wall...

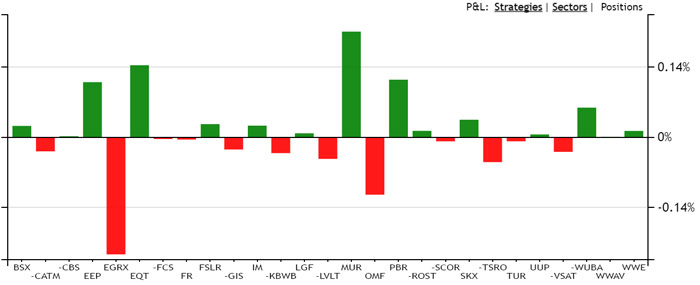

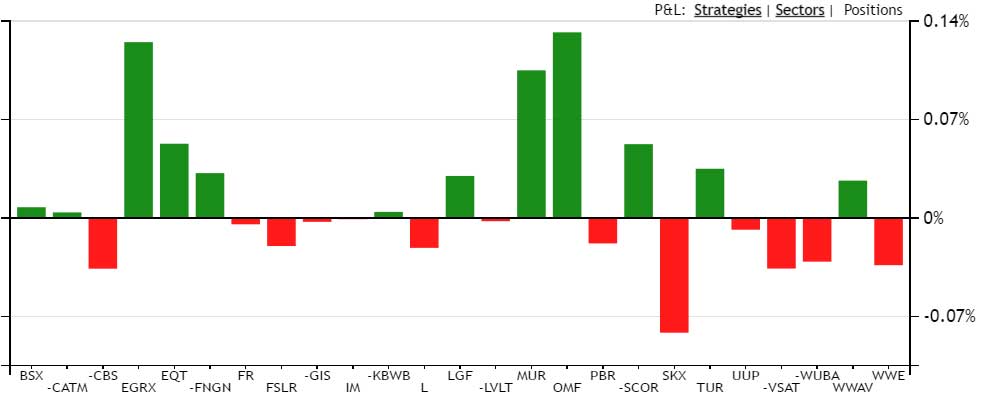

Activity in individual stocks picking up. $BSX, $EGRX, $MDVN all bought this week. $WUBA, $FNGN, $KBWB shorted. $OMF rebought this month after already trading it last month.

Overall positioning looks like a continuation of the long Brazil/oil theme but now also with healthcare while selectively buying and shorting financial names. It seems like there's a lot of anticipation on catalysts coming up on many of these names ranging from healthcare events to potential acquisitions on other names.

Overall positioning looks like a continuation of the long Brazil/oil theme but now also with healthcare while selectively buying and shorting financial names. It seems like there's a lot of anticipation on catalysts coming up on many of these names ranging from healthcare events to potential acquisitions on other names.

pftq (Official) says on The Tech Trader Wall...

Market slightly down but $OMF up almost 4% today. Still holding due to April call buying.

pftq (Official) says on The Tech Trader Wall...

959 unique view(s)

March 30th, 2016

pftq (Official) says on The Tech Trader Wall...

Brazil trade working out especially well today after Fed again. Names like $PBR up above $6 now from Tech Trader's entry around $5.

pftq (Official) says on The Tech Trader Wall...

1015 unique view(s)

March 24th, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader coming alive again w/ an intraday bottom on $XLK at $43.35. Only one so far - like first shots fired to test the waters.

More interestingly, Tech Trader's 100% hitrate once-in-a-blue-moon SPY buy signal might trigger today as well. All of us here are watching excitingly to see if we'll get yet another signal this year only 3 months into the year, which is very unusual and points to just how different the current market is from the last few years.

More interestingly, Tech Trader's 100% hitrate once-in-a-blue-moon SPY buy signal might trigger today as well. All of us here are watching excitingly to see if we'll get yet another signal this year only 3 months into the year, which is very unusual and points to just how different the current market is from the last few years.

pftq (Official) says on The Tech Trader Wall...

Looks like that $XLK signal was enough for the market to rally back to the close. Little disappointing, but we'll see if the market gives us a second chance to buy next week.

1106 unique view(s)

March 18th, 2016

pftq (Official) says on The Tech Trader Wall...

Funny but not serious note is $VRX (Valeant) has a short-term buy on an older RSI strategy at $29.5 with a target price of $45; not traded but interesting to watch, as that strategy has a 80% hitrate on all its signals.

pftq (Official) says on The Tech Trader Wall...

Ton of bullish trendline breaks this week. This just from today: $ASNA $DWA $FLT $FIVE $HR $L $NAVI $NGL $RDN $SFM $SMLP $SWFT $TGI $TSLA $UNP

These from past few days: $APD $BAM $BKE $CBI $CBL $CCJ $CPA $D $D $DKS $DOV $DYN $E $ENLC $EPE $EQM $EQM $EQT $FCE-A $FLEX $GGP $GPK $HES $HPP $IBN $KT $KYN $LBTYA $LPI $LPT $LSTR $MAC $NFG $NS $OPK $PH $RRD $SCCO $SHOO $SNE $SRE $SRE $STLD $SU $TSL $TU $UNF $UNFI $UNFI $UPS $WBC $WPC $WYN $XLE $XPO

Normally very bullish when you get huge clusters like this. Again, older strategy not traded but good to monitor.

These from past few days: $APD $BAM $BKE $CBI $CBL $CCJ $CPA $D $D $DKS $DOV $DYN $E $ENLC $EPE $EQM $EQM $EQT $FCE-A $FLEX $GGP $GPK $HES $HPP $IBN $KT $KYN $LBTYA $LPI $LPT $LSTR $MAC $NFG $NS $OPK $PH $RRD $SCCO $SHOO $SNE $SRE $SRE $STLD $SU $TSL $TU $UNF $UNFI $UNFI $UPS $WBC $WPC $WYN $XLE $XPO

Normally very bullish when you get huge clusters like this. Again, older strategy not traded but good to monitor.

pftq (Official) says on The Tech Trader Wall...

And there goes $INSY, just jumped 6% to $18 and still going.

pftq (Official) says on The Tech Trader Wall...

Tech Trader back into $OMF on the same April call buying, this time at $31 strike. Seems like someone is really betting on it going above $30 by next month. Funny stock to watch because it always has 10% up days after it pulls back.

OMF 4/15/2016 31x Calls, 5000@$1.0499

MV: $0.5M | $Not.: $5.0M | OI: 0 | 19.9% TotalOI

24.3% StockVolume | 46.6% OptionVolume

OMF 4/15/2016 31x Calls, 5000@$1.0499

MV: $0.5M | $Not.: $5.0M | OI: 0 | 19.9% TotalOI

24.3% StockVolume | 46.6% OptionVolume

1073 unique view(s)

March 17th, 2016

pftq (Official) says on The Tech Trader Wall...

Brazil theme finally playing out in size after Fed, with names like PBR, ITUB, and EWZ up 8-10% a piece today. AMD also up 5% on talks about Intel licensing their GPU patents. Last theme to watch would be the marijuana one with INSY, which is presenting at a conference tomorrow.

1037 unique view(s)

March 16th, 2016

pftq (Official) says on The Tech Trader Wall...

Been a rather uneventful couple of months, but it looks like Tech Trader is finally building a couple themes here, first with Brazil (note that it cut ITUB and RIO though), then marijuana (INSY), and now potentially virtual reality with AMD. These are longer medium term plays, so we'll see how these play out.

1035 unique view(s)

March 14th, 2016

pftq (Official) says on The Tech Trader Wall...

1108 unique view(s)

March 11th, 2016

pftq (Official) says on The Tech Trader Wall...

1117 unique view(s)

March 10th, 2016

pftq (Official) says on The Tech Trader Wall...

Much of the market flat today after all the whipsaw, but IHUB and PBR from a couple days ago are up about 5% a piece. Not really sure why, but interesting to watch.

1229 unique view(s)

March 8th, 2016

pftq (Official) says on The Tech Trader Wall...

Starting to finally see some shakiness in the market. The XLU long and SMH short call from last week is starting to play out pretty well now.

Some other interesting observations are that Brazillian names in particular are being picked up on the long side. Tech Trader overall is still net short though.

Some other interesting observations are that Brazillian names in particular are being picked up on the long side. Tech Trader overall is still net short though.

1399 unique view(s)

March 5th, 2016

dipsea (Guest) says on The Tech Trader Wall...

Excellent data worth considering. Thanks

1398 unique view(s)

March 4th, 2016

pftq (Official) says on The Tech Trader Wall...

XLU up over a percent since the bottom call a couple days ago, which is just weird since it's the opposite of what you'd expect with how rates are moving on the stronger than expected job numbers, but we'll take what we can get.

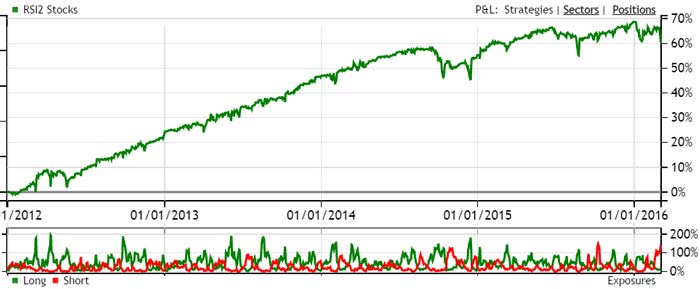

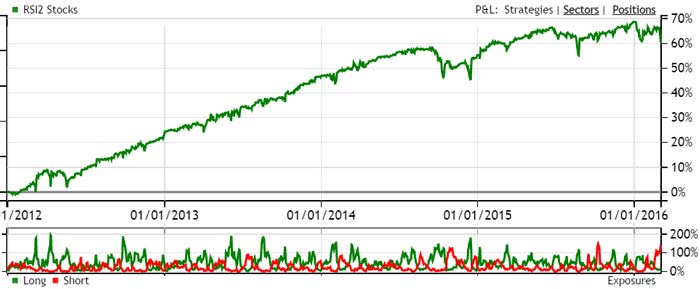

Tech Trader still net short (50% cash, 20% long, 50% short) but pretty much holding flat in performance despite the market rally. It's basically choosing to sidestep the rally out of caution. Some older strategies that are not traded live but we still monitor are also flagging extremely bearish, namely our RSI2 stocks which very rarely is over 100% short is currently 130% short and continuing to add. Main takeaway is the market is coming off very overbought and risk is high to the downside.

Below is the current exposure of the older RSI2 stocks strategy; it's not traded live for the obvious volatility in performance, but the peak exposure periods have a hitrate of 90% with those periods only happening a couple times a year.

Tech Trader still net short (50% cash, 20% long, 50% short) but pretty much holding flat in performance despite the market rally. It's basically choosing to sidestep the rally out of caution. Some older strategies that are not traded live but we still monitor are also flagging extremely bearish, namely our RSI2 stocks which very rarely is over 100% short is currently 130% short and continuing to add. Main takeaway is the market is coming off very overbought and risk is high to the downside.

Below is the current exposure of the older RSI2 stocks strategy; it's not traded live for the obvious volatility in performance, but the peak exposure periods have a hitrate of 90% with those periods only happening a couple times a year.

buck.andrews (Guest) says on The Tech Trader Wall...

Thanks for the explanation. This helps me to better understand tech trader.

1392 unique view(s)

March 2nd, 2016

pftq (Official) says on The Tech Trader Wall...

CS and OMF up about 2-3% each. Not sure why; we're watching closely just to see what happens, as often times these can be frontrunning some kind of news.

Tech Trader overall getting net short again though both by shorting more and getting out of existing long positions. It is also getting more defensive with what it has left over in long names. SMH just got shorted and XLU is being bought on intraday bottom, both of which are defensive signs.

Tech Trader overall getting net short again though both by shorting more and getting out of existing long positions. It is also getting more defensive with what it has left over in long names. SMH just got shorted and XLU is being bought on intraday bottom, both of which are defensive signs.