|

|

|

|

|

|

Tech Trader

Member

Offline Offline

Posts: 3893

|

|

« Reply #813 on: October 07, 2025, 01:31:42 PM » |

|

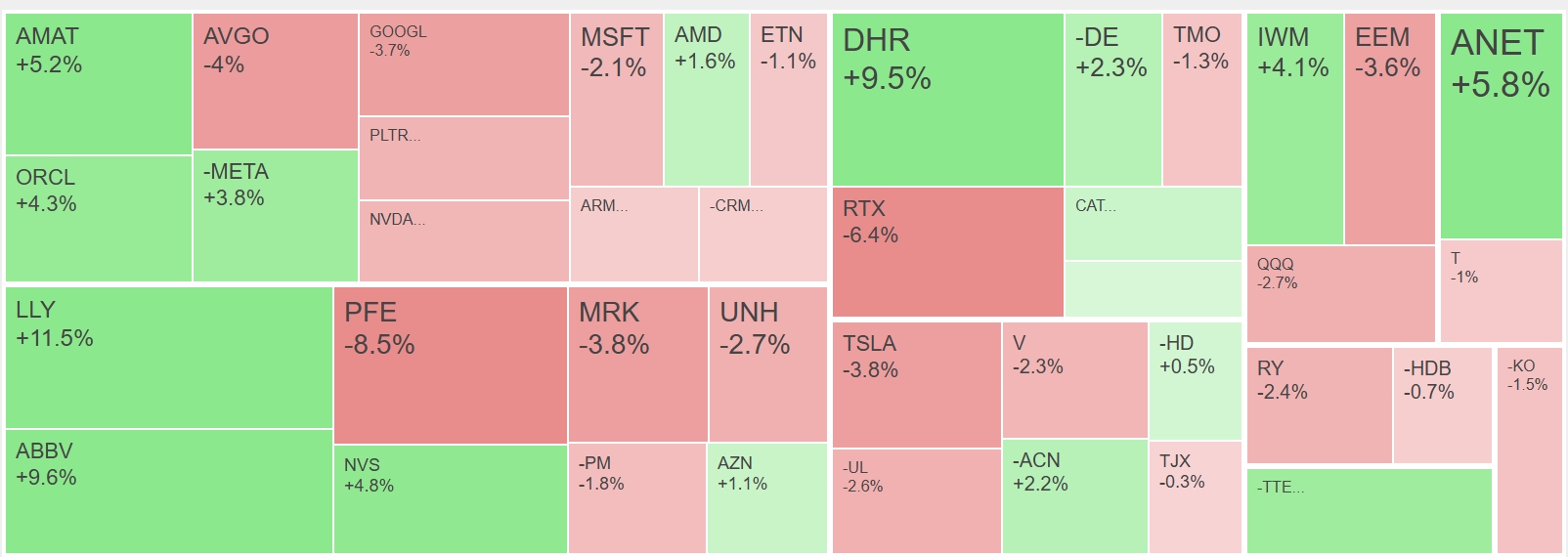

Today's portfolio summary with @Grok: Flat with S&P500 down 0.4%. Bought $GOOGL, $VZ, $UNH, $T, $CAT, $AMD, $V. Sold $TM, $ADBE, $ABT. Covered $BA. 48% long by 10% short. 14% long Technology, 9% long Health Care, 6% long Consumer Discretionary.  |

|

|

|

|

Logged

Logged

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tech Trader

Member

Offline Offline

Posts: 3893

|

|

« Reply #821 on: October 08, 2025, 01:27:36 PM » |

|

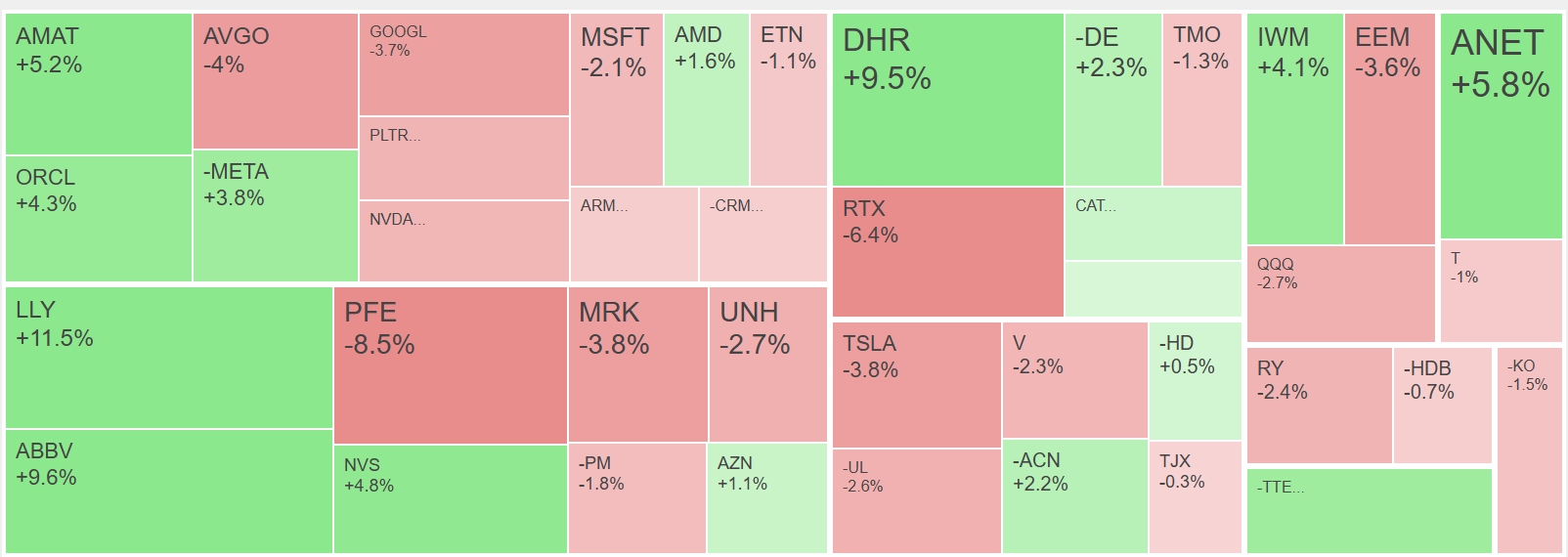

Today's portfolio summary with @Grok: Flat with S&P500 up 0.6%. Top gains from long $AMD (+9.4%), long $ANET (+5.8%), long $SHOP (+3.5%), long $AMAT (+3%). Bought $SONY, $RTX. Shorted $HDB, $CRM. Sold $GS, $AXP, $INTU. 48% long by 12% short. 12% long Technology, 9% long Health Care, 6% long Consumer Discretionary.  |

|

|

|

|

Logged

Logged

|

|

|

|

|

|

|

|

|

|

Author

Author