45 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $NEXT (+5.1%).

49% long by 0% short. 14% long Industrials, 10% long Health Care, 7% long Technology. See current positions.

49% long by 0% short. 14% long Industrials, 10% long Health Care, 7% long Technology. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $NSC.

53% long by 0% short. 18% long Industrials, 11% long Health Care, 7% long Technology. See current positions.

53% long by 0% short. 18% long Industrials, 11% long Health Care, 7% long Technology. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $SLGN.

57% long by 0% short. 22% long Industrials, 11% long Health Care, 7% long Technology. See current positions.

57% long by 0% short. 22% long Industrials, 11% long Health Care, 7% long Technology. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $ENTG.

Sold $SU (+2.8%).

57% long by 0% short. 22% long Industrials, 11% long Health Care, 10% long Technology. See current positions.

Sold $SU (+2.8%).

57% long by 0% short. 22% long Industrials, 11% long Health Care, 10% long Technology. See current positions.

52 unique view(s)

June 9th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $NEXT.

60% long by 0% short. 14% long Industrials, 11% long Consumer Discretionary, 10% long Health Care, 7% long Technology. See current positions.

60% long by 0% short. 14% long Industrials, 11% long Consumer Discretionary, 10% long Health Care, 7% long Technology. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $HD (-1.6%), $VIPS (+7.2%).

53% long by 0% short. 14% long Industrials, 10% long Health Care, 7% long Technology. See current positions.

53% long by 0% short. 14% long Industrials, 10% long Health Care, 7% long Technology. See current positions.

46 unique view(s)

June 8th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $HD.

Sold $AVB (+2.4%).

57% long by 0% short. 14% long Industrials, 11% long Consumer Discretionary, 10% long Health Care, 7% long Technology. See current positions.

Sold $AVB (+2.4%).

57% long by 0% short. 14% long Industrials, 11% long Consumer Discretionary, 10% long Health Care, 7% long Technology. See current positions.

56 unique view(s)

June 7th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $GEHC, $CBRE, $AIRC, $FTV.

57% long by 0% short. 15% long Industrials, 10% long Health Care, 7% long Consumer Discretionary, 7% long Real Estate, 7% long Technology. See current positions.

57% long by 0% short. 15% long Industrials, 10% long Health Care, 7% long Consumer Discretionary, 7% long Real Estate, 7% long Technology. See current positions.

58 unique view(s)

June 6th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $PANW (+6.8%).

43% long by 0% short. 11% long Health Care, 10% long Industrials, 7% long Technology. See current positions.

43% long by 0% short. 11% long Health Care, 10% long Industrials, 7% long Technology. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $VIPS.

Sold $FOLD (+17.2%).

43% long by 0% short. 11% long Industrials, 7% long Technology, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

Sold $FOLD (+17.2%).

43% long by 0% short. 11% long Industrials, 7% long Technology, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

47 unique view(s)

June 5th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $CNP.

Sold $PK (+3.5%).

47% long by 0% short. 11% long Health Care, 11% long Technology, 10% long Industrials. See current positions.

Sold $PK (+3.5%).

47% long by 0% short. 11% long Health Care, 11% long Technology, 10% long Industrials. See current positions.

56 unique view(s)

June 2nd, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

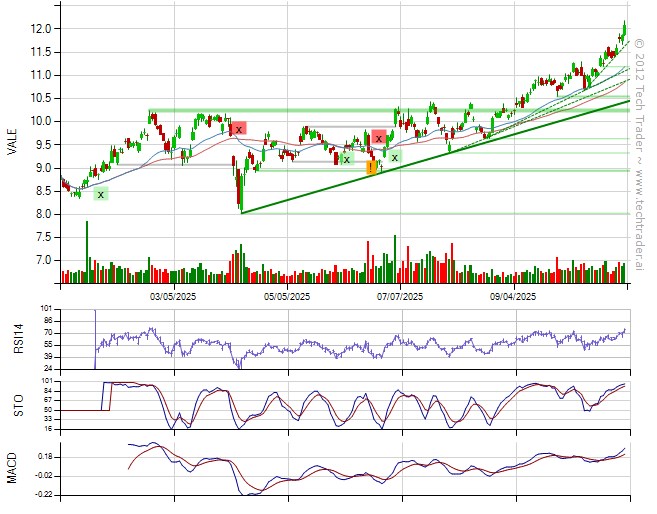

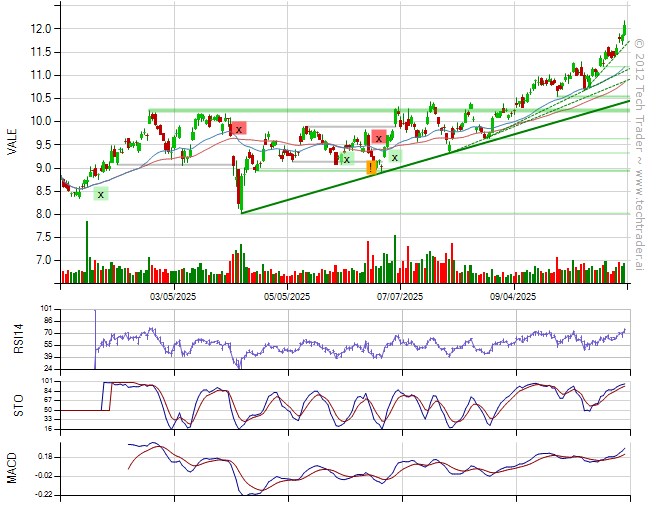

Sold $VALE (+7.7%), $NFLX (+1.8%).

47% long by 0% short. 11% long Health Care, 11% long Industrials, 11% long Technology, 7% long Real Estate. See current positions.

47% long by 0% short. 11% long Health Care, 11% long Industrials, 11% long Technology, 7% long Real Estate. See current positions.

54 unique view(s)

May 31st, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $ACN.

49% long by 3% short. 11% long Health Care, 10% long Industrials, 7% long Real Estate, 7% long Technology, 7% long Consumer Discretionary. See current positions.

49% long by 3% short. 11% long Health Care, 10% long Industrials, 7% long Real Estate, 7% long Technology, 7% long Consumer Discretionary. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $VALE.

Covered $IOT (+3.6%).

52% long by 0% short. 11% long Health Care, 10% long Industrials, 10% long Technology, 7% long Consumer Discretionary, 7% long Real Estate. See current positions.

Covered $IOT (+3.6%).

52% long by 0% short. 11% long Health Care, 10% long Industrials, 10% long Technology, 7% long Consumer Discretionary, 7% long Real Estate. See current positions.

41 unique view(s)

May 30th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $ETRN (+47.4%).

50% long by 0% short. 18% long Technology, 11% long Health Care, 10% long Industrials, 7% long Real Estate. See current positions.

50% long by 0% short. 18% long Technology, 11% long Health Care, 10% long Industrials, 7% long Real Estate. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Shorted $IOT.

49% long by 4% short. 15% long Technology, 11% long Health Care, 10% long Industrials, 7% long Real Estate. See current positions.

49% long by 4% short. 15% long Technology, 11% long Health Care, 10% long Industrials, 7% long Real Estate. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $NFLX.

Sold $PSTG (+14.8%), $NTNX (-0.4%).

46% long by 4% short. 11% long Health Care, 10% long Industrials, 7% long Real Estate, 7% long Technology. See current positions.

Sold $PSTG (+14.8%), $NTNX (-0.4%).

46% long by 4% short. 11% long Health Care, 10% long Industrials, 7% long Real Estate, 7% long Technology. See current positions.

58 unique view(s)

May 26th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $TEX, $PANW, $NTNX.

Sold $AKAM (+5.6%).

53% long by 0% short. 18% long Technology, 11% long Health Care, 10% long Industrials, 7% long Real Estate. See current positions.

Sold $AKAM (+5.6%).

53% long by 0% short. 18% long Technology, 11% long Health Care, 10% long Industrials, 7% long Real Estate. See current positions.

51 unique view(s)

May 25th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $SU.

42% long by 0% short. 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Technology. See current positions.

42% long by 0% short. 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Technology. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $PSTG.

46% long by 0% short. 11% long Health Care, 10% long Technology, 7% long Industrials, 7% long Real Estate. See current positions.

46% long by 0% short. 11% long Health Care, 10% long Technology, 7% long Industrials, 7% long Real Estate. See current positions.

45 unique view(s)

May 24th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $ETRN.

49% long by 0% short. 14% long Technology, 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Consumer Discretionary. See current positions.

49% long by 0% short. 14% long Technology, 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Consumer Discretionary. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $RPD (+2.5%), $TAL (-4.2%), $ARRY (+0.7%).

39% long by 0% short. 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Technology. See current positions.

39% long by 0% short. 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Technology. See current positions.

48 unique view(s)

May 22nd, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $TGI.

50% long by 0% short. 14% long Technology, 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Consumer Discretionary. See current positions.

50% long by 0% short. 14% long Technology, 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Consumer Discretionary. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

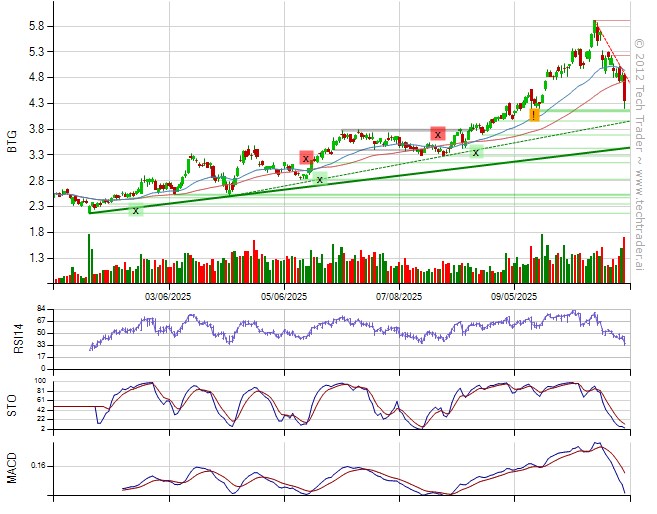

Sold $BTG (-5.7%).

47% long by 0% short. 14% long Technology, 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Consumer Discretionary. See current positions.

47% long by 0% short. 14% long Technology, 11% long Health Care, 7% long Industrials, 7% long Real Estate, 7% long Consumer Discretionary. See current positions.

50 unique view(s)

May 19th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $ARE (-6.5%).

46% long by 0% short. 14% long Technology, 11% long Health Care, 7% long Real Estate, 7% long Consumer Discretionary. See current positions.

46% long by 0% short. 14% long Technology, 11% long Health Care, 7% long Real Estate, 7% long Consumer Discretionary. See current positions.

46 unique view(s)

May 18th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $IMVT.

57% long by 0% short. 18% long Technology, 14% long Health Care, 11% long Real Estate, 7% long Consumer Discretionary. See current positions.

57% long by 0% short. 18% long Technology, 14% long Health Care, 11% long Real Estate, 7% long Consumer Discretionary. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $AMBA (+7.6%), $IMVT (+0.4%).

49% long by 0% short. 14% long Technology, 11% long Health Care, 11% long Real Estate, 7% long Consumer Discretionary. See current positions.

49% long by 0% short. 14% long Technology, 11% long Health Care, 11% long Real Estate, 7% long Consumer Discretionary. See current positions.

49 unique view(s)

May 17th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $FOLD.

52% long by 0% short. 18% long Technology, 11% long Real Estate, 10% long Health Care, 7% long Consumer Discretionary. See current positions.

52% long by 0% short. 18% long Technology, 11% long Real Estate, 10% long Health Care, 7% long Consumer Discretionary. See current positions.

48 unique view(s)

May 15th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $IPGP.

46% long by 0% short. 14% long Technology, 11% long Real Estate, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

46% long by 0% short. 14% long Technology, 11% long Real Estate, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $ARRY.

50% long by 0% short. 18% long Technology, 11% long Real Estate, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

50% long by 0% short. 18% long Technology, 11% long Real Estate, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

42 unique view(s)

May 12th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $RPD.

42% long by 4% short. 11% long Real Estate, 11% long Technology, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

42% long by 4% short. 11% long Real Estate, 11% long Technology, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Covered $HEI (+2.8%).

42% long by 0% short. 11% long Real Estate, 10% long Technology, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

42% long by 0% short. 11% long Real Estate, 10% long Technology, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

45 unique view(s)

May 11th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $AKAM.

39% long by 4% short. 11% long Real Estate, 7% long Technology, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

39% long by 4% short. 11% long Real Estate, 7% long Technology, 7% long Consumer Discretionary, 7% long Health Care. See current positions.

45 unique view(s)

May 10th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $PK.

36% long by 4% short. 11% long Real Estate, 7% long Technology, 7% long Health Care. See current positions.

36% long by 4% short. 11% long Real Estate, 7% long Technology, 7% long Health Care. See current positions.

65 unique view(s)

May 8th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $AMBA, $VRNA.

31% long by 4% short. 7% long Health Care, 7% long Real Estate, 7% long Technology. See current positions.

31% long by 4% short. 7% long Health Care, 7% long Real Estate, 7% long Technology. See current positions.

57 unique view(s)

May 5th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $IGT (-2.2%).

21% long by 4% short. 7% long Real Estate, 4% short Industrials. See current positions.

21% long by 4% short. 7% long Real Estate, 4% short Industrials. See current positions.

70 unique view(s)

May 4th, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $HAYW.

24% long by 4% short. 7% long Real Estate, 6% long Consumer Discretionary, 4% short Industrials. See current positions.

24% long by 4% short. 7% long Real Estate, 6% long Consumer Discretionary, 4% short Industrials. See current positions.

81 unique view(s)

May 2nd, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $TECH (-4%), $HZNP (+0.8%).

20% long by 4% short. 7% long Real Estate, 6% long Consumer Discretionary, 4% short Industrials. See current positions.

20% long by 4% short. 7% long Real Estate, 6% long Consumer Discretionary, 4% short Industrials. See current positions.

61 unique view(s)

May 1st, 2023

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $IGT.

32% long by 7% short. 11% long Health Care, 7% long Real Estate, 7% long Consumer Discretionary, 4% short Finance. See current positions.

32% long by 7% short. 11% long Health Care, 7% long Real Estate, 7% long Consumer Discretionary, 4% short Finance. See current positions.