776 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

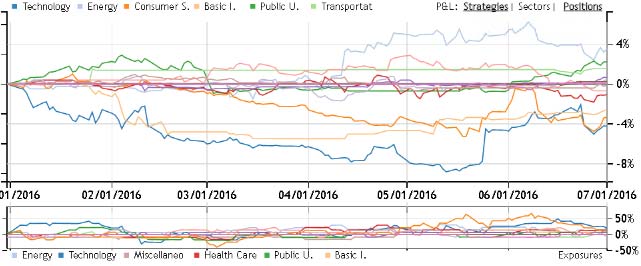

Up a bit over 1% for June vs $SPY down slightly despite being very long into Brexit. Exposures back to neutral at 70% long by 20% short with no real sector bet, though an old favorite $PBR has come back into play. Tech Trader just expecting continued breakout, but we as humans might see it as a cup-and-handle formation.

twgarry (Guest) says on The Tech Trader Wall...

good month.

zonayev (Guest) says on The Tech Trader Wall...

I was in Europe for two weeks and spoke to many people from UK. At least 80% of them wanted to vote Leave. I quickly repositioned my portfolio and told my boss about it. Anyways very good month indeed, although I hear many people underperformed. It seems that most people were long with tail hedged but not many people were quick enough to remove hedges on Monday. Central banks are so powerful and quick nowadays, they don't tolerate even small dislocations.

When SPX declined by more than 1.5% and VIX fell on the same day, we witnessed a strong rebound in 8 out of 10 cases. On average, SPX was up 3% in 2 weeks after these rare occurrences. This time rebound was even stronger and market rotated into defensive sectors at the same time. It remains to be seen whether defensive trade gets unraveled next. NFP report next Friday is probably the main data point now.

Sent from my iPhone

>

When SPX declined by more than 1.5% and VIX fell on the same day, we witnessed a strong rebound in 8 out of 10 cases. On average, SPX was up 3% in 2 weeks after these rare occurrences. This time rebound was even stronger and market rotated into defensive sectors at the same time. It remains to be seen whether defensive trade gets unraveled next. NFP report next Friday is probably the main data point now.

Sent from my iPhone

>

749 unique view(s)

June 30th, 2016

791 unique view(s)

June 27th, 2016

pftq (Official) says on The Tech Trader Wall...

Wrong about Brexit, but positions like short $BTI turned out to hedge us a bit. Will see if Tech Trader's market timing trades start kicking in today to average down.

866 unique view(s)

June 22nd, 2016

908 unique view(s)

June 15th, 2016

pftq (Official) says on The Tech Trader Wall...

928 unique view(s)

June 14th, 2016

1012 unique view(s)

June 9th, 2016

1034 unique view(s)

June 8th, 2016

pftq (Official) says on The Tech Trader Wall...

Picked up $WPG from the massive price spike at close on deal chatter. Spiked minutes before the news; go figure.

1071 unique view(s)

June 6th, 2016

pftq (Official) says on The Tech Trader Wall...

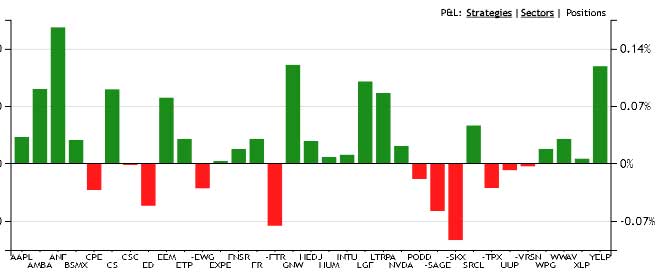

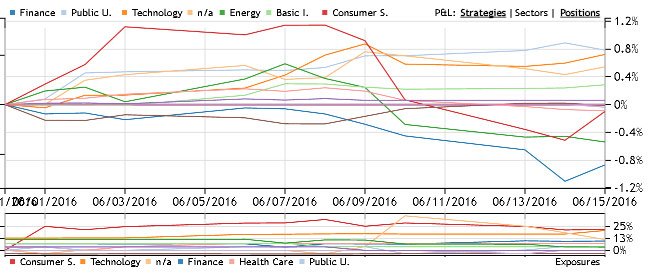

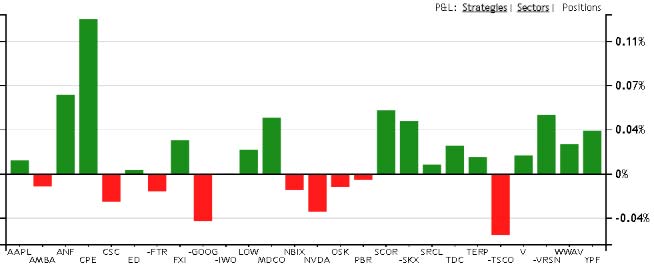

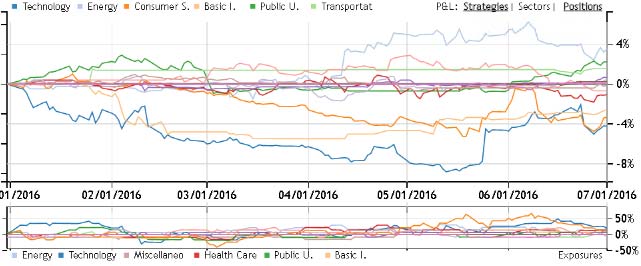

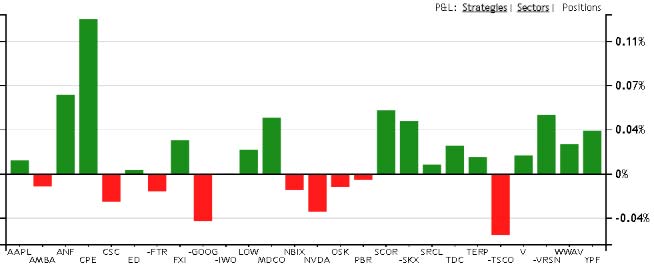

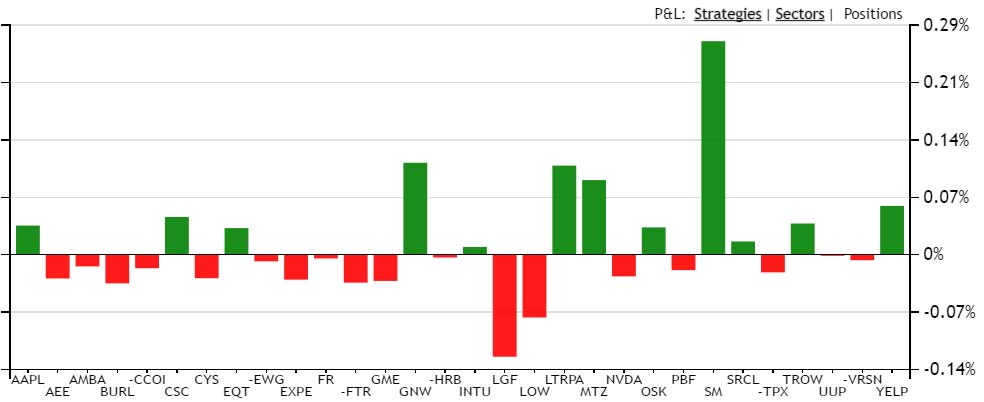

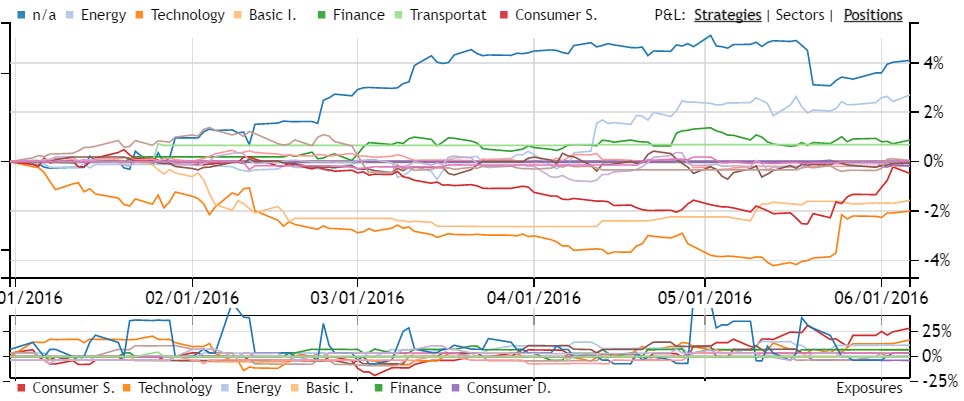

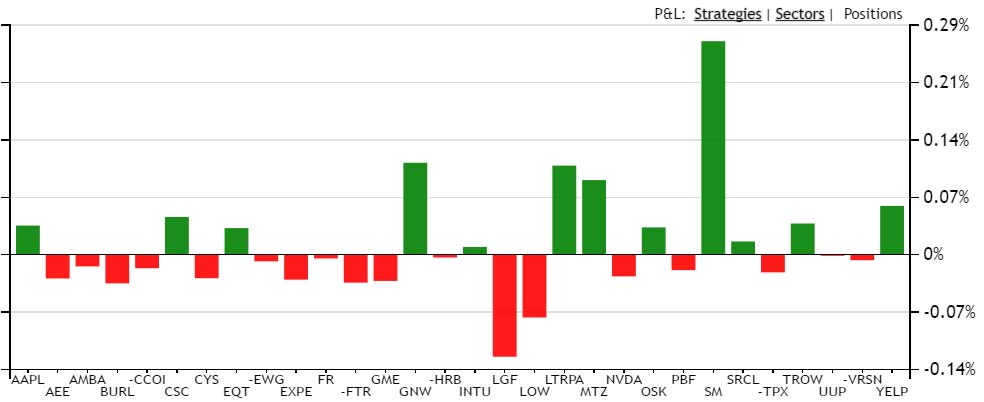

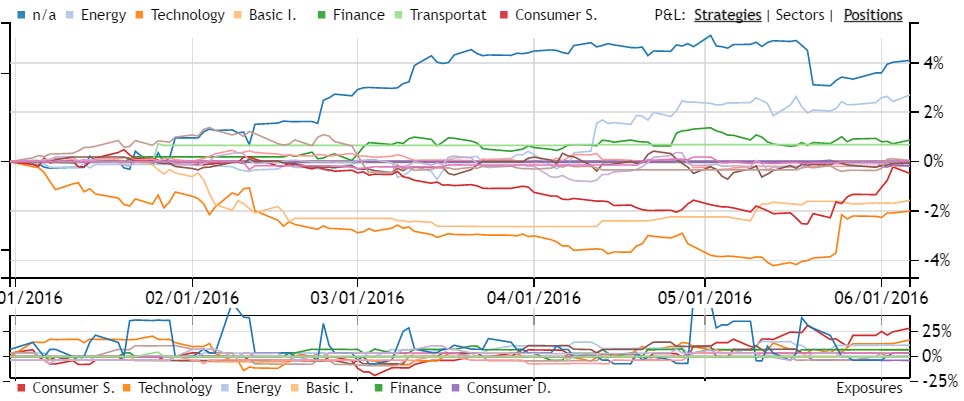

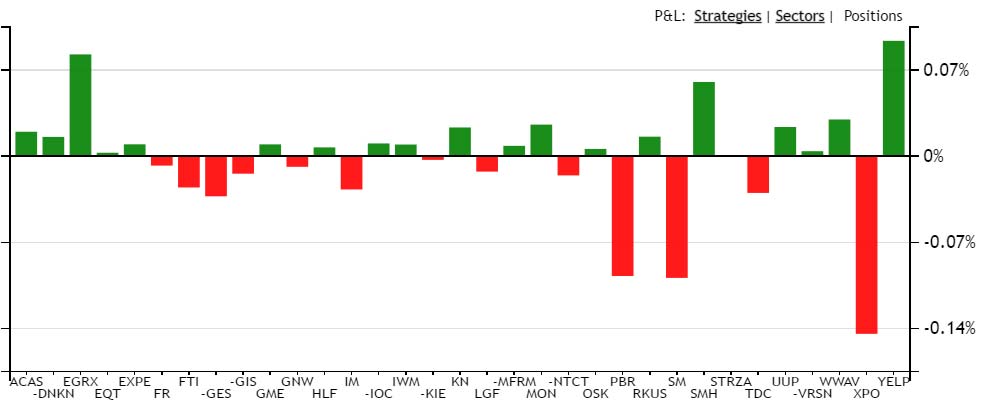

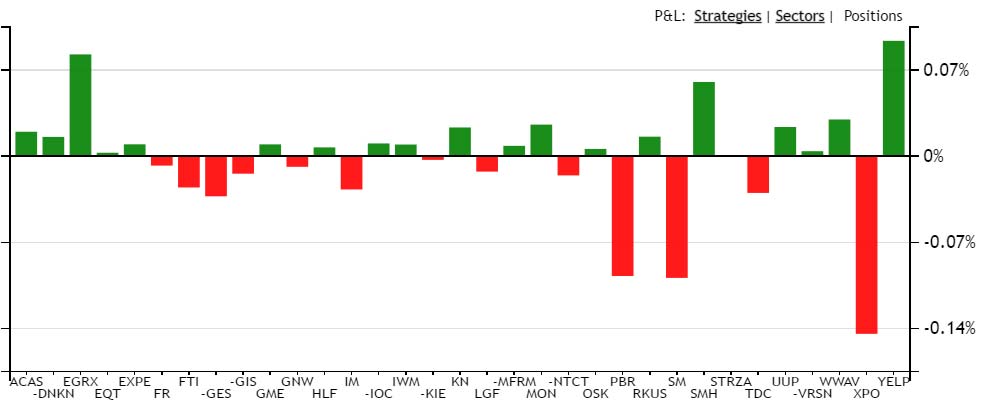

Tech Trader doing well across the board with $SPY breaking year highs after going fully invested long back in May, which at the time seemed counter-intuitive with all the bearish talk on the streets, hawkish Fed, and expectations of sell-in-May seasonal weakness. Sector exposures are still largely long Consumer but as you can see in the chart below, it is very long everything else as well with next largest exposures being Technology and Energy.

As we noted back in May, Tech Trader has finally “woken up” and is fully invested net long across the board, with largest exposures in Consumer at 30%, followed by Technology and Energy but otherwise evenly distributed on most other sectors. It is most ironic but all the more impressive that Tech Trader has constantly gone against the conventional thinking this year by staying out of the market in January (against “January effect”), buying Energy in March (against those worried about oil), and most recently buying almost everything across the board (against “sell-in-May” and worries about Fed raising rates). That said, Tech Trader is also making returns primarily from stock selection and not general market movement (although the market has also started going back to highs). Some of the largest gains in the past month, for example, have been from shorting brick-and-mortar retail names like MFRM, TPX, and BBY (mattresses and Best Buy) as well as more specific catalyst names like GOGO (airline internet) and CXRX (failed healthcare deal). Many of the names on the long side are also very specific niches like smaller content providers (LGF, STRZA, YELP, LTRPA) and, in a way, the bigger companies in Silicon Valley (AAPL, INTU, AMBA, NVDA). Lastly, what’s interesting to observe is all these bets Tech Trader takes (even the Energy one which started in mid-March) all take months to play out, confirming out emphasis that Tech Trader is neither quant nor high-frequency but actually investing on a medium-to-long-term horizon. As we head into the Fed meeting in mid-June, we expect Tech Trader’s bet against everyone’s rate-hike fears will hold steady and surprise to the upside.

As we noted back in May, Tech Trader has finally “woken up” and is fully invested net long across the board, with largest exposures in Consumer at 30%, followed by Technology and Energy but otherwise evenly distributed on most other sectors. It is most ironic but all the more impressive that Tech Trader has constantly gone against the conventional thinking this year by staying out of the market in January (against “January effect”), buying Energy in March (against those worried about oil), and most recently buying almost everything across the board (against “sell-in-May” and worries about Fed raising rates). That said, Tech Trader is also making returns primarily from stock selection and not general market movement (although the market has also started going back to highs). Some of the largest gains in the past month, for example, have been from shorting brick-and-mortar retail names like MFRM, TPX, and BBY (mattresses and Best Buy) as well as more specific catalyst names like GOGO (airline internet) and CXRX (failed healthcare deal). Many of the names on the long side are also very specific niches like smaller content providers (LGF, STRZA, YELP, LTRPA) and, in a way, the bigger companies in Silicon Valley (AAPL, INTU, AMBA, NVDA). Lastly, what’s interesting to observe is all these bets Tech Trader takes (even the Energy one which started in mid-March) all take months to play out, confirming out emphasis that Tech Trader is neither quant nor high-frequency but actually investing on a medium-to-long-term horizon. As we head into the Fed meeting in mid-June, we expect Tech Trader’s bet against everyone’s rate-hike fears will hold steady and surprise to the upside.

twgarry (Guest) says on The Tech Trader Wall...

Well done!

Sent from my iPhone

>

Sent from my iPhone

>

1046 unique view(s)

June 3rd, 2016

pftq (Official) says on The Tech Trader Wall...

Another big win from shorting $GOGO, down as much as 17% this morning. Opened flat but probably just a gap-fill like $LGF which opened flat but went back to premarket prices by end of day. Originally shorted last week due to unusual buying detected on the $10-strike puts.

GOGO 6/17/2016 10x Puts, 9000@$0.4

MV: $0.4M | $Not.: $2.6M | OI: 305 | 22.3% TotalOI

2.9% StockVolume | 47.2% OptionVolume

GOGO 6/17/2016 10x Puts, 9000@$0.4

MV: $0.4M | $Not.: $2.6M | OI: 305 | 22.3% TotalOI

2.9% StockVolume | 47.2% OptionVolume

pftq (Official) says on The Tech Trader Wall...

1067 unique view(s)

June 2nd, 2016

pftq (Official) says on The Tech Trader Wall...

Two big winners today in long $CIEN and short $CXRX, both from options activity. Heavy call buying yesterday in $CIEN before its earnings beat today and a large bearish risk reversal in $CXRX last week before the Blackstone takeover fell apart just now. All the news and talk around $CXRX was positive until just now, so whoever bought that risk reversal last week was betting against the crowd.

pftq (Official) says on The Tech Trader Wall...

1120 unique view(s)

May 27th, 2016

pftq (Official) says on The Tech Trader Wall...

Last week, we noted Tech Trader was buying virtually everything across the board and seemed to be short the dollar, except that it strangely bought $UUP (the dollar ETF) as well. Ironically both $SPY and $UUP are now testing highs. Funny how things play out.

It seems like all the seasonal patterns are breaking down this year (January effect, sell in May, etc). Happy holiday weekend to everyone and looking forward to see what comes next.

It seems like all the seasonal patterns are breaking down this year (January effect, sell in May, etc). Happy holiday weekend to everyone and looking forward to see what comes next.

1164 unique view(s)

May 26th, 2016

pftq (Official) says on The Tech Trader Wall...

Had a question about our $AAPL trade - Tech Trader is looking at it as a longer term play with resistance at ~ $112. The system identified a lot of accumulation in the $90s and below (the "BOT" flags) and will likewise hold for medium-long term or until it sees similar magnitude in selling. See chart below.

pftq (Official) says on The Tech Trader Wall...

$LGF basically a free gain this morning opening at pre-earnings price of $19.76; was above $22 yesterday after hours. Call buyers that got us into the stock in the first place are targeting $24 strike for June.

LGF 6/17/2016 24x Calls, 3400@$1.2999

MV: $0.4M | $Not.: $3.1M | OI: 1583 | 10.9% TotalOI

3.8% StockVolume | 54.5% OptionVolume

LGF 6/17/2016 24x Calls, 3400@$1.2999

MV: $0.4M | $Not.: $3.1M | OI: 1583 | 10.9% TotalOI

3.8% StockVolume | 54.5% OptionVolume

1158 unique view(s)

May 25th, 2016

pftq (Official) says on The Tech Trader Wall...

Market back to all-time highs. Both longs and shorts working. $CSC up 30% on merger while $BBY dropped 7% despite beating earnings. Even the $UUP dollar bet is up, which is ironic. Still very long consumer, energy, and healthcare here while being short brick-and-mortar. For whatever reason, Tech Trader is short a bunch of brick-and-mortar mattress companies $MFRM and $TPX; looking forward to see how those turn out.

twgarry (Guest) says on The Tech Trader Wall...

Well done

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

1243 unique view(s)

May 18th, 2016

pftq (Official) says on The Tech Trader Wall...

Shorted $BBY on $1M puts being bought. Tech Trader just hating on retails even though it's long all other consumers.

zonayev (Guest) says on The Tech Trader Wall...

Tough bet after today's hawkish FOMC minutes. I hope your UUP bet is big enough to offset "short dollar" longs, in case dollar strength continues. Good luck!

Sent from my iPhone

>

Sent from my iPhone

>

1237 unique view(s)

May 17th, 2016

rppp (Guest) says on The Tech Trader Wall...

What does Techtrader say about George Soros’ big short bet against SPY?

pftq (Official) says on The Tech Trader Wall...

The weird thing is we're up with the market down despite our 90% long by

30% short exposure, so it's hard to interpret what that means as in terms

of where S&P500 is going. I would say it almost seems Tech Trader is

agnostic and only cares about Energy, Healthcare, Tech, Consumer here (even

then, it's very idiosyncratic since it's actually also short specific areas

like brick-and-mortor retail).

30% short exposure, so it's hard to interpret what that means as in terms

of where S&P500 is going. I would say it almost seems Tech Trader is

agnostic and only cares about Energy, Healthcare, Tech, Consumer here (even

then, it's very idiosyncratic since it's actually also short specific areas

like brick-and-mortor retail).

pftq (Official) says on The Tech Trader Wall...

Our beta for the year is 0.2 - effectively uncorrelated to the market.

rppp (Guest) says on The Tech Trader Wall...

Exactly why I asked. The chatter in the news media is that Soros has a “big put bet” However Techtrader doesn’t read news which in this case is great.

zonayev (Guest) says on The Tech Trader Wall...

We have a massive 'risk on' rally today (high beta is outperforming low

beta by over 2%). USD is down after a 10-day rally. You must have a high

exposure to Oil and Beta which is saving you today.

beta by over 2%). USD is down after a 10-day rally. You must have a high

exposure to Oil and Beta which is saving you today.

1167 unique view(s)

May 16th, 2016

pftq (Official) says on The Tech Trader Wall...

$AAPL flagging a bottom as well as being near multi-year-support. Older less-used algorithm but interesting to note nonetheless.

1174 unique view(s)

May 13th, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader continuing to get longer here, almost 100% long by 30% short. Biggest bets are Consumer, Energy, and then Healthcare. Most interesting names in the last few days are $MON, $STRZA, and $EGRX, which are getting increased buying activity in both stock and options after the initial signals. Tech Trader overall is getting much more idiosyncratic in its bets with long Consumer names like $YELP and $WWAV but also short Consumer names like $MFRM and $DNKN.

zonayev (Guest) says on The Tech Trader Wall...

As I expected, Chinese loan data came out well below consensus. Credit conditions are tightening. Not good for risk.

Sent from my iPhone

>

Sent from my iPhone

>

1151 unique view(s)

May 11th, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader's been gradually rotating back into Energy this week: $PBR, $EQT, $FTI, $SM

Looks like it was a play into the oil report today, which caused the energy sector to flip from negative to positive this morning.

Tech Trader overall (if you look at the chart from yesterday) is now mainly long Energy, Consumer, and Healthcare. Again, exposures are at year highs now with longs at 96% and shorts at 33%.

$PBR and $EQT are old favorites of Tech Trader; been in and out of those since March. $FTI and $SM are new ones picked up from risk reversal activity in the options market.

Looks like it was a play into the oil report today, which caused the energy sector to flip from negative to positive this morning.

Tech Trader overall (if you look at the chart from yesterday) is now mainly long Energy, Consumer, and Healthcare. Again, exposures are at year highs now with longs at 96% and shorts at 33%.

$PBR and $EQT are old favorites of Tech Trader; been in and out of those since March. $FTI and $SM are new ones picked up from risk reversal activity in the options market.

zonayev (Guest) says on The Tech Trader Wall...

Chinese data is not out yet. The oil number is bullish but not clear how much of the draw is due to wildfires in Canada. Let's see if Oil holds its gains into close.

Sent from my iPhone

>

Sent from my iPhone

>

1156 unique view(s)

May 10th, 2016

pftq (Official) says on The Tech Trader Wall...

Out of $SPY now but still very long with $PAH, $WWAV, $EGRX, and many other names finally playing out after months of consolidation. Tech Trader remains 90% long by 30% short, the most invested we've been all year since going 60% cash in November. I expect this will continue into the end of Q2 with many people who expect seasonal weakness to be disappointed. If you look at the charts below, many names we have are just now starting to break to the upside.

zonayev (Guest) says on The Tech Trader Wall...

Good luck. Tomorrow's Oil report and Chinese data later this week would set up the tone. I expect loan data from China to be weak. Today buyback window is reopened, so we have incremental buying from fundamental insensitive players.

Sent from my iPhone

>

Sent from my iPhone

>

1128 unique view(s)

May 7th, 2016

twgarry (Guest) says on The Tech Trader Wall...

Nice call on yelp

Sent from my iPhone

>

Sent from my iPhone

>