726 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

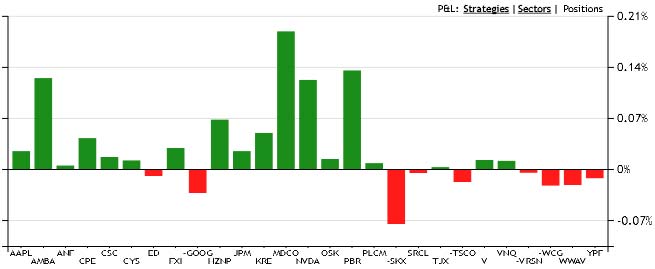

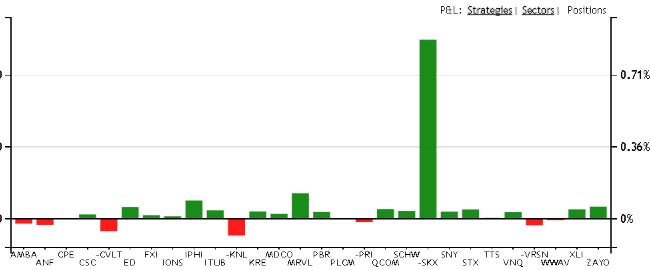

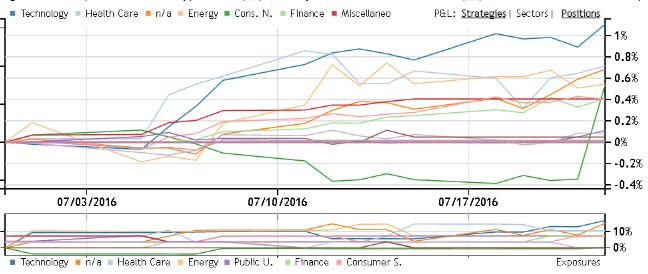

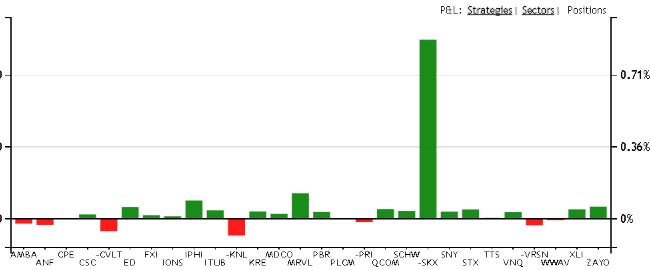

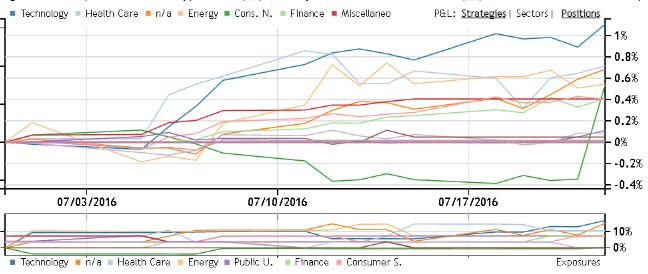

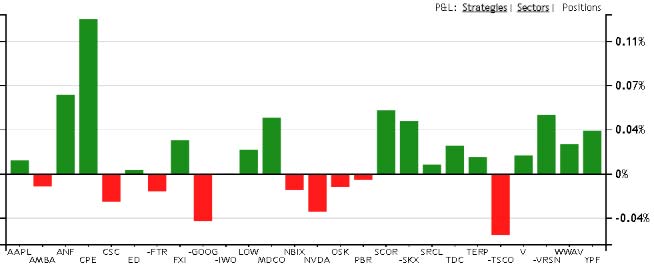

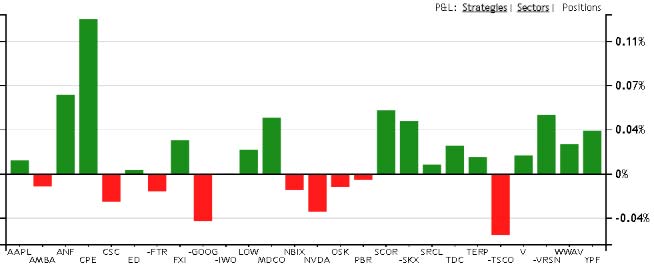

Big day for Tech Trader with short $SKX alone making over a percent for the portfolio. The rest of the portfolio even without $SKX is still outperforming $SPY at over half a percent. For July alone, Tech Trader is currently up 5%. Exposures are holding at about 90% long by 20% short with 10% cash. Sectors are a pretty neutral 10% even across the board with the top 3 being tech, healthcare, and energy, but as we saw with today, the positions are so idiosyncratic that performance can come from anywhere.

twgarry (Guest) says on The Tech Trader Wall...

great job!

730 unique view(s)

July 20th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Are you guys still long TLT? Tomorrow is ECB, likely would be bearish for bonds. Draghi normally is able to lift sentiment, hence German yields, at least for one day. Then FOMC next week. You could get some relief and opportunity to exit before Fed. Post Fed I can see TLT taking another leg down ahead of BOJ. After BOJ, I have no view. Helicopter money could be the game changer. Let's see.

Sent from my iPhone

>

Sent from my iPhone

>

762 unique view(s)

July 14th, 2016

zonayev (Guest) says on The Tech Trader Wall...

I hope you exited TLT yesterday. Are you buying again today?

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

I think TLT goes lower. ECB is next week and BOJ is end of the month.

Central banks are back in a driving seat.

Gold is less certain cause selling pressure on Treasuries is weakening USD

that marginally help Gold. Gold is down over 1% now but Gold miners are

up. This can't continue unless yields fall back down.

Central banks are back in a driving seat.

Gold is less certain cause selling pressure on Treasuries is weakening USD

that marginally help Gold. Gold is down over 1% now but Gold miners are

up. This can't continue unless yields fall back down.

815 unique view(s)

July 13th, 2016

pftq (Official) says on The Tech Trader Wall...

$TLT up a percent today after yesterday's buy. Nice hedge while the market takes a breather.

zonayev (Guest) says on The Tech Trader Wall...

Nice bounce today! Good job! Equities are not fully risk off (dollar is weak) but TLT is working. Weak Oil is def helping your trade. Let me know when you exit:)

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

Final short being added for the day in $TXMD.

789 unique view(s)

July 12th, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader buying $TLT on pullback. Reminds me of when it was long both stock and dollar index and somehow both worked out.

zonayev (Guest) says on The Tech Trader Wall...

My model is short TLT and GLD. But good luck with your trade. Your hope that risk aversion comes back.

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Note that today Utilities finally started to sell off after holding up well for some time. Higher yields would likely dislocate Utilities the most since they are overbought, have weak fundamentals and pay relatively low dividend ( based on past history).

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

Thanks. Our $TLT trade should be short term just for a bounce. We are still about 70% long by 25% short excluding that.

789 unique view(s)

July 11th, 2016

pftq (Official) says on The Tech Trader Wall...

$SPY at new highs despite Brexit. Funny part is we mis-interpreted TT's long bet to be stay, but it didn't matter as it ended up outperforming anyway.

zonayev (Guest) says on The Tech Trader Wall...

The rebound from June 27th bottom is almost done. It peaks around 2-3 weeks from the bottom. I think the worst case scenario is equity and bond simultaneous sell off (risk parity unwind). Probably will be in September, while for now I like EM and beta.

Sent from my iPhone

>

Sent from my iPhone

>

726 unique view(s)

July 9th, 2016

pftq (Official) says on The Tech Trader Wall...

For those curious about the technology, we have uploaded our talk at Hyperloop last month: https://www.youtube.com/watch?v=2qcbzFyPtqM

752 unique view(s)

July 8th, 2016

pftq (Official) says on The Tech Trader Wall...

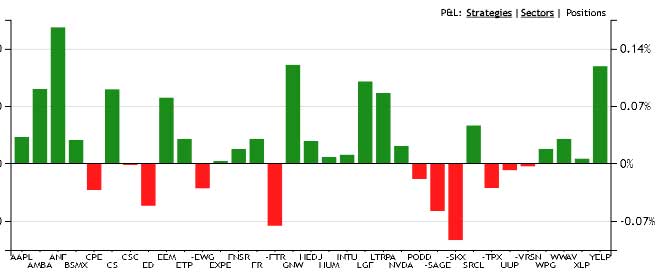

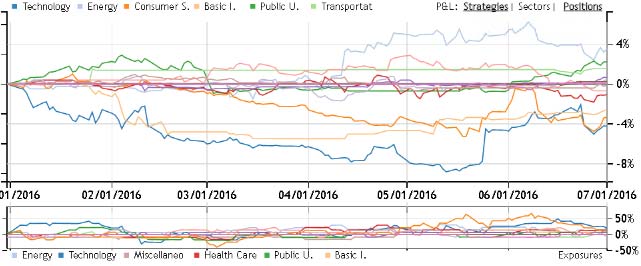

Loading up on breakout longs again, this time $BMRN, $PLCM, $TJX, $WWAV (again). Was very long into Brexit but turned out not to matter as $SPY just broke year highs. Still only 80% long by 15% short right now but managing to capture full performance of the S&P even without being fully invested. Sector exposures are still neutral though with no one sector more than 10% exposure.

TimothyB (Guest) says on The Tech Trader Wall...

charset=utf-8

Thanks! These post and Tech trader are really interesting!

>

Thanks! These post and Tech trader are really interesting!

>

760 unique view(s)

July 7th, 2016

pftq (Official) says on The Tech Trader Wall...

$WWAV another name bought out after having lots of suspicious call buying, but again already out. Tech Trader is very tight this year, hopefully loosens up soon to stop missing these.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

773 unique view(s)

July 2nd, 2016

pftq (Official) says on The Tech Trader Wall...

Up a bit over 1% for June vs $SPY down slightly despite being very long into Brexit. Exposures back to neutral at 70% long by 20% short with no real sector bet, though an old favorite $PBR has come back into play. Tech Trader just expecting continued breakout, but we as humans might see it as a cup-and-handle formation.

twgarry (Guest) says on The Tech Trader Wall...

good month.

zonayev (Guest) says on The Tech Trader Wall...

I was in Europe for two weeks and spoke to many people from UK. At least 80% of them wanted to vote Leave. I quickly repositioned my portfolio and told my boss about it. Anyways very good month indeed, although I hear many people underperformed. It seems that most people were long with tail hedged but not many people were quick enough to remove hedges on Monday. Central banks are so powerful and quick nowadays, they don't tolerate even small dislocations.

When SPX declined by more than 1.5% and VIX fell on the same day, we witnessed a strong rebound in 8 out of 10 cases. On average, SPX was up 3% in 2 weeks after these rare occurrences. This time rebound was even stronger and market rotated into defensive sectors at the same time. It remains to be seen whether defensive trade gets unraveled next. NFP report next Friday is probably the main data point now.

Sent from my iPhone

>

When SPX declined by more than 1.5% and VIX fell on the same day, we witnessed a strong rebound in 8 out of 10 cases. On average, SPX was up 3% in 2 weeks after these rare occurrences. This time rebound was even stronger and market rotated into defensive sectors at the same time. It remains to be seen whether defensive trade gets unraveled next. NFP report next Friday is probably the main data point now.

Sent from my iPhone

>

749 unique view(s)

June 30th, 2016

791 unique view(s)

June 27th, 2016

pftq (Official) says on The Tech Trader Wall...

Wrong about Brexit, but positions like short $BTI turned out to hedge us a bit. Will see if Tech Trader's market timing trades start kicking in today to average down.

865 unique view(s)

June 22nd, 2016

908 unique view(s)

June 15th, 2016

pftq (Official) says on The Tech Trader Wall...

925 unique view(s)

June 14th, 2016

1012 unique view(s)

June 9th, 2016

1030 unique view(s)

June 8th, 2016

pftq (Official) says on The Tech Trader Wall...

Picked up $WPG from the massive price spike at close on deal chatter. Spiked minutes before the news; go figure.

1071 unique view(s)

June 6th, 2016

pftq (Official) says on The Tech Trader Wall...

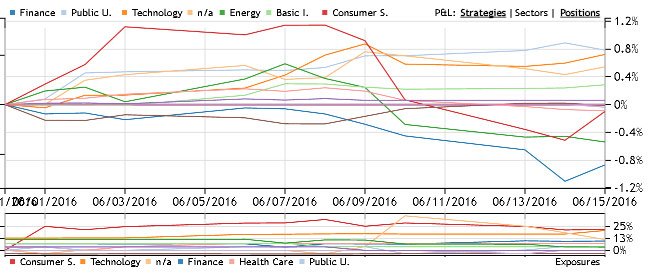

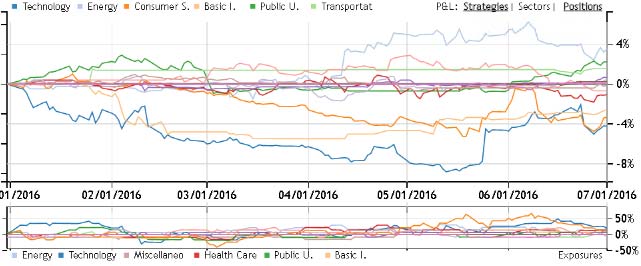

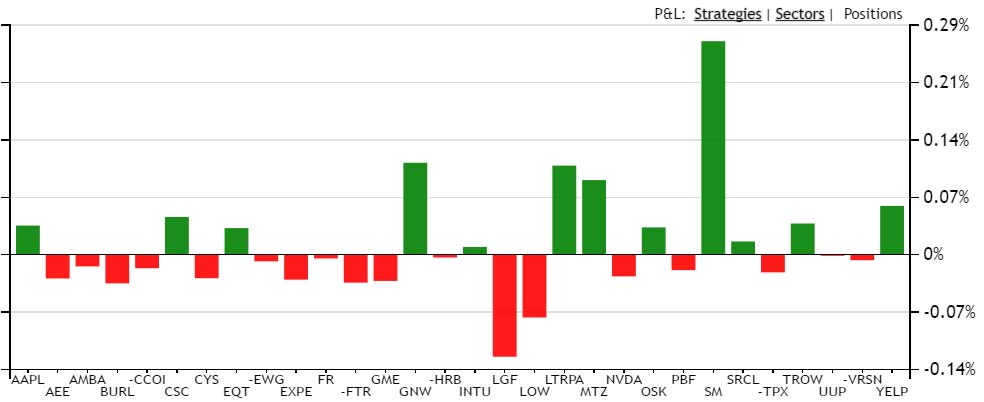

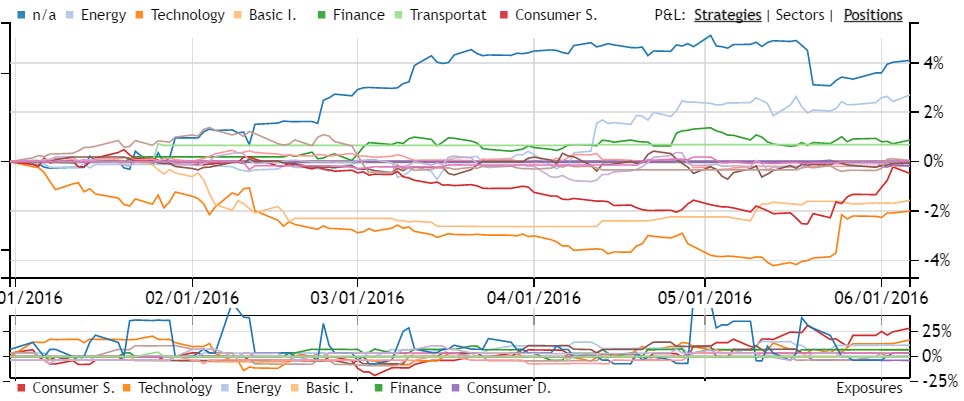

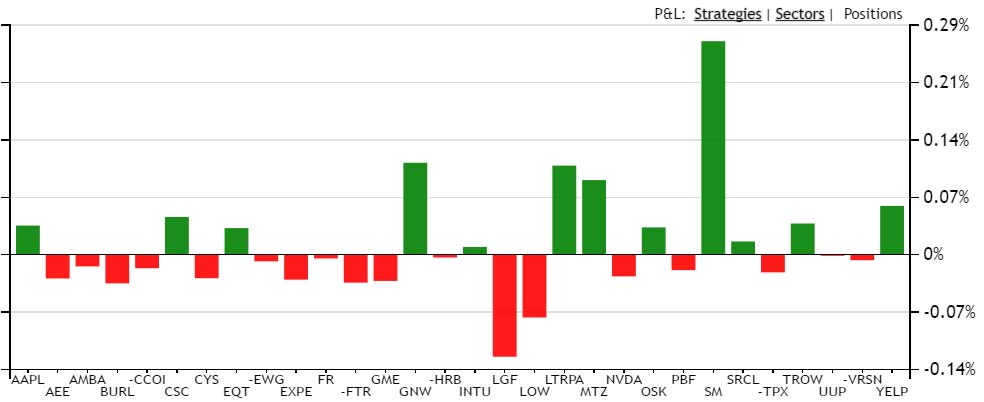

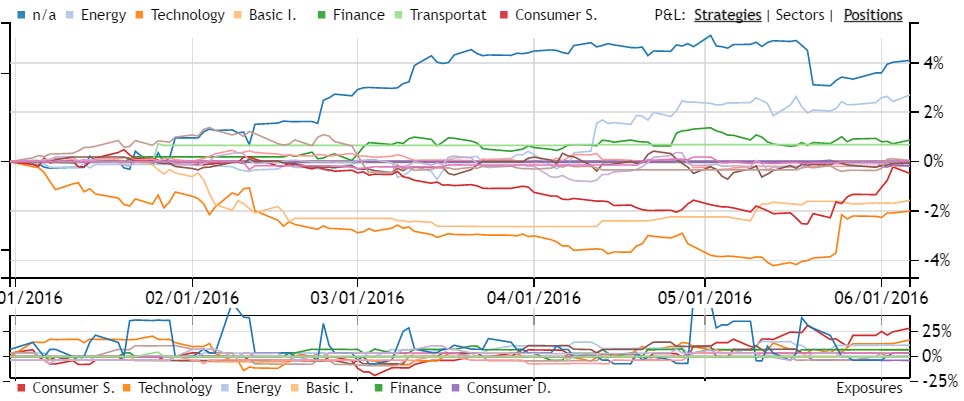

Tech Trader doing well across the board with $SPY breaking year highs after going fully invested long back in May, which at the time seemed counter-intuitive with all the bearish talk on the streets, hawkish Fed, and expectations of sell-in-May seasonal weakness. Sector exposures are still largely long Consumer but as you can see in the chart below, it is very long everything else as well with next largest exposures being Technology and Energy.

As we noted back in May, Tech Trader has finally “woken up” and is fully invested net long across the board, with largest exposures in Consumer at 30%, followed by Technology and Energy but otherwise evenly distributed on most other sectors. It is most ironic but all the more impressive that Tech Trader has constantly gone against the conventional thinking this year by staying out of the market in January (against “January effect”), buying Energy in March (against those worried about oil), and most recently buying almost everything across the board (against “sell-in-May” and worries about Fed raising rates). That said, Tech Trader is also making returns primarily from stock selection and not general market movement (although the market has also started going back to highs). Some of the largest gains in the past month, for example, have been from shorting brick-and-mortar retail names like MFRM, TPX, and BBY (mattresses and Best Buy) as well as more specific catalyst names like GOGO (airline internet) and CXRX (failed healthcare deal). Many of the names on the long side are also very specific niches like smaller content providers (LGF, STRZA, YELP, LTRPA) and, in a way, the bigger companies in Silicon Valley (AAPL, INTU, AMBA, NVDA). Lastly, what’s interesting to observe is all these bets Tech Trader takes (even the Energy one which started in mid-March) all take months to play out, confirming out emphasis that Tech Trader is neither quant nor high-frequency but actually investing on a medium-to-long-term horizon. As we head into the Fed meeting in mid-June, we expect Tech Trader’s bet against everyone’s rate-hike fears will hold steady and surprise to the upside.

As we noted back in May, Tech Trader has finally “woken up” and is fully invested net long across the board, with largest exposures in Consumer at 30%, followed by Technology and Energy but otherwise evenly distributed on most other sectors. It is most ironic but all the more impressive that Tech Trader has constantly gone against the conventional thinking this year by staying out of the market in January (against “January effect”), buying Energy in March (against those worried about oil), and most recently buying almost everything across the board (against “sell-in-May” and worries about Fed raising rates). That said, Tech Trader is also making returns primarily from stock selection and not general market movement (although the market has also started going back to highs). Some of the largest gains in the past month, for example, have been from shorting brick-and-mortar retail names like MFRM, TPX, and BBY (mattresses and Best Buy) as well as more specific catalyst names like GOGO (airline internet) and CXRX (failed healthcare deal). Many of the names on the long side are also very specific niches like smaller content providers (LGF, STRZA, YELP, LTRPA) and, in a way, the bigger companies in Silicon Valley (AAPL, INTU, AMBA, NVDA). Lastly, what’s interesting to observe is all these bets Tech Trader takes (even the Energy one which started in mid-March) all take months to play out, confirming out emphasis that Tech Trader is neither quant nor high-frequency but actually investing on a medium-to-long-term horizon. As we head into the Fed meeting in mid-June, we expect Tech Trader’s bet against everyone’s rate-hike fears will hold steady and surprise to the upside.

twgarry (Guest) says on The Tech Trader Wall...

Well done!

Sent from my iPhone

>

Sent from my iPhone

>

1045 unique view(s)

June 3rd, 2016

pftq (Official) says on The Tech Trader Wall...

Another big win from shorting $GOGO, down as much as 17% this morning. Opened flat but probably just a gap-fill like $LGF which opened flat but went back to premarket prices by end of day. Originally shorted last week due to unusual buying detected on the $10-strike puts.

GOGO 6/17/2016 10x Puts, 9000@$0.4

MV: $0.4M | $Not.: $2.6M | OI: 305 | 22.3% TotalOI

2.9% StockVolume | 47.2% OptionVolume

GOGO 6/17/2016 10x Puts, 9000@$0.4

MV: $0.4M | $Not.: $2.6M | OI: 305 | 22.3% TotalOI

2.9% StockVolume | 47.2% OptionVolume

pftq (Official) says on The Tech Trader Wall...