1098 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

1082 unique view(s)

October 24th, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader buying $TWX on today's dip after seeing a large risk reversal buy for December:

TWX 12/16/2016 90x Calls, 17500@$1.5399

MV: $2.7M | $Not.: $53.6M | OI: 867 | 7.6% TotalOI

2.9% StockVolume | 16.6% OptionVolume

Leg: TWX 12/16/2016 82.5x Puts, 17500 on OI of 305

TWX 12/16/2016 90x Calls, 17500@$1.5399

MV: $2.7M | $Not.: $53.6M | OI: 867 | 7.6% TotalOI

2.9% StockVolume | 16.6% OptionVolume

Leg: TWX 12/16/2016 82.5x Puts, 17500 on OI of 305

1083 unique view(s)

October 21st, 2016

TimothyB (Guest) says on The Tech Trader Wall...

Just wondering about TT.

Sent from my iPad

>

Sent from my iPad

>

zonayev (Guest) says on The Tech Trader Wall...

You are shorting USD and buying stocks that perform well in weak USD environment. Can you explain what strategy is shorting USD?

Today's price action ( Oil, Gold and EM are all strong despite USD move) probably means that market is expecting mean reversion in USD. I can see that USD breakout from this level can do real damage to risk but it seems market is fading derivatives of strong USD trade.

Thanks,

Zhan

Sent from my iPhone

>

Today's price action ( Oil, Gold and EM are all strong despite USD move) probably means that market is expecting mean reversion in USD. I can see that USD breakout from this level can do real damage to risk but it seems market is fading derivatives of strong USD trade.

Thanks,

Zhan

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

The individual stock trades are based on stock volume. The short $UUP is based on put buying in the options. So in both stock and options market, Tech Trader is seeing large trades betting either against USD or for long the equity. I think it's the latter; the stocks we are buying I think have a more idiosyncratic theme that will reveal themselves.

zonayev (Guest) says on The Tech Trader Wall...

Thanks!

Sent from my iPhone

>

Sent from my iPhone

>

1097 unique view(s)

October 13th, 2016

zonayev (Guest) says on The Tech Trader Wall...

I agree with TT. No panic sell off yet. Need to see bank results tomorrow and Yellen is speaking tomorrow.

Sent from my iPhone

>

Sent from my iPhone

>

1085 unique view(s)

October 11th, 2016

pftq (Official) says on The Tech Trader Wall...

Very interesting that Tech Trader is not buying this dip in $SPY here. Reminds me of January.

1031 unique view(s)

October 10th, 2016

1134 unique view(s)

September 29th, 2016

1151 unique view(s)

September 28th, 2016

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

The $USO trade on $3.3M in call buying last week is doing well from Saudi cutting oil production today. Whoever bought those calls was likely expecting this.

1146 unique view(s)

September 23rd, 2016

1137 unique view(s)

September 22nd, 2016

1138 unique view(s)

September 21st, 2016

1129 unique view(s)

September 20th, 2016

pftq (Official) says on The Tech Trader Wall...

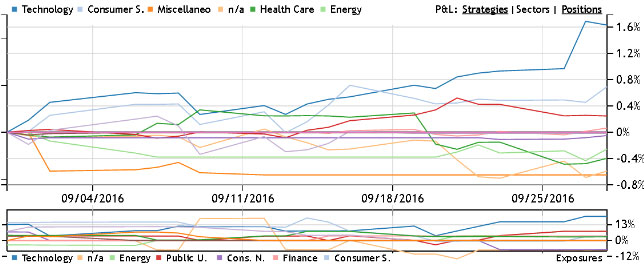

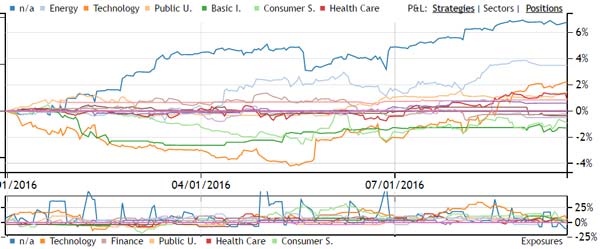

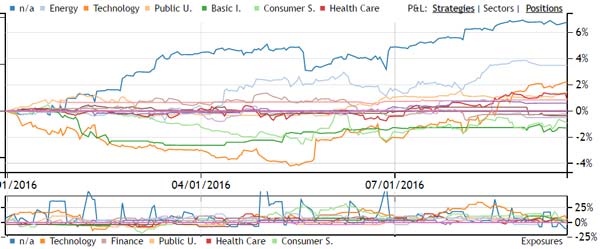

Tech Trader now technically net short with 32% long and 36% short exposure.

pftq (Official) says on The Tech Trader Wall...

Updated with graphs and snapshot.

zonayev (Guest) says on The Tech Trader Wall...

Why your gross is so low? Does it mean model is highly uncertain about next few weeks?

Sent from my iPhone

>

Sent from my iPhone

>

1127 unique view(s)

September 19th, 2016

pftq (Official) says on The Tech Trader Wall...

1153 unique view(s)

September 16th, 2016

1174 unique view(s)

September 14th, 2016

1155 unique view(s)

September 13th, 2016

pftq (Official) says on The Tech Trader Wall...

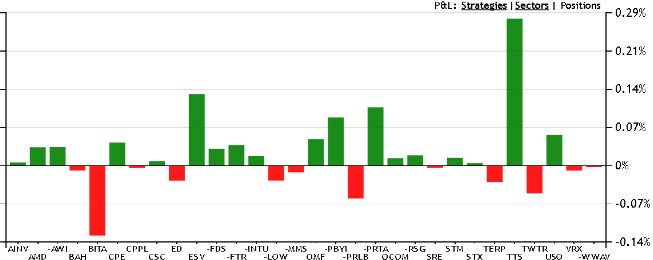

Still getting shorter, sold another position and then shorted $INTU. Exposures now 50% long by 25% short.

zonayev (Guest) says on The Tech Trader Wall...

Makes sense. I remain net short. Risk parity funds are blowing up now. Nowhere to hide.

Sent from my iPhone

>

Sent from my iPhone

>

1069 unique view(s)

September 12th, 2016

pftq (Official) says on The Tech Trader Wall...

Market already rebounding from Friday. Tech Trader barely got a few punches in before the sell off ended. Ah well.

zonayev (Guest) says on The Tech Trader Wall...

Ended? Do you see signs that it ended or is it just a beginning? What do

you look at? VIX? Thanks

you look at? VIX? Thanks

pftq (Official) says on The Tech Trader Wall...

Tech Trader continuing to cut both longs and shorts. Exposure now 61% long by 21% short if you exclude the short-term ETF buys from Friday.

zonayev (Guest) says on The Tech Trader Wall...

Why are you cutting? Do you think a selloff would continue?

My model oddly is buying USD.

Thanks

Sent from my iPhone

>

My model oddly is buying USD.

Thanks

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

Not necessarily bearish, just neutral. It's just not seeing positions it wants to stay in at this time.

zonayev (Guest) says on The Tech Trader Wall...

Got it. Thanks!

Sent from my iPhone

>

Sent from my iPhone

>

1082 unique view(s)

September 9th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Good luck. You are buying a very overvalued market but central banks could come and save us. I am scared to be long ahead of FEd and BOJ on 21st.

Sent from my iPhone

>

Sent from my iPhone

>

998 unique view(s)

September 8th, 2016

TimothyB (Guest) says on The Tech Trader Wall...

Are you surprised that TT hasn't bought financials? Neither Euro nor US. What is your interpretation?

Sent from my iPad

>

Sent from my iPad

>

pftq (Official) says on The Tech Trader Wall...

In general, I would think of inaction exactly as just that - inaction. It

just doesn't see any opportunity but it doesn't mean it's bearish. Tech

Trader is very conservative, so it takes a lot of ideal conditions for it

to want to make a trade.

just doesn't see any opportunity but it doesn't mean it's bearish. Tech

Trader is very conservative, so it takes a lot of ideal conditions for it

to want to make a trade.

TimothyB (Guest) says on The Tech Trader Wall...

Thanks for the reply. Fascinated by this AI.

Sent from my iPad

>

Sent from my iPad

>