751 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

803 unique view(s)

August 12th, 2016

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

797 unique view(s)

August 11th, 2016

pftq (Official) says on The Tech Trader Wall...

812 unique view(s)

August 9th, 2016

pftq (Official) says on The Tech Trader Wall...

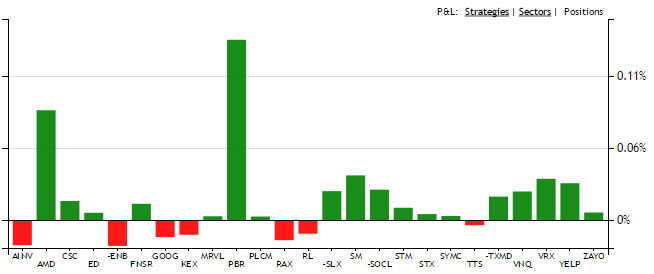

$YELP up an additional 5% after hours coincidentally.

753 unique view(s)

August 4th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Do you see any big put spread trades in XLP over past few weeks? Thanks!

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

None that we can see are notable.

zonayev (Guest) says on The Tech Trader Wall...

Thanks!

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

$SYMC up about 5% after hours on beat. Initial reports were that it missed; hence why we trade price and not news.

755 unique view(s)

July 29th, 2016

pftq (Official) says on The Tech Trader Wall...

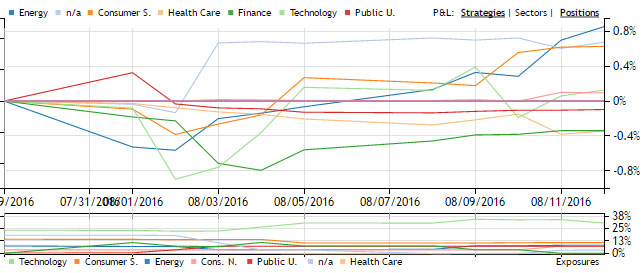

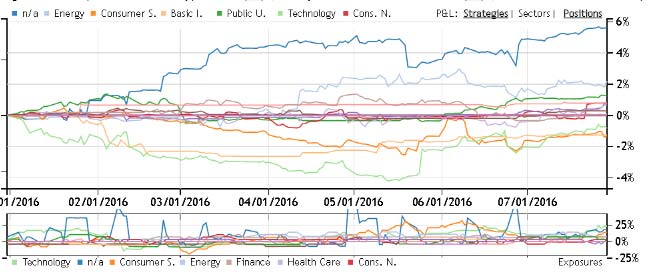

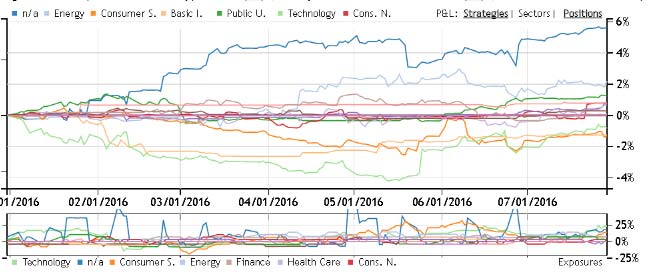

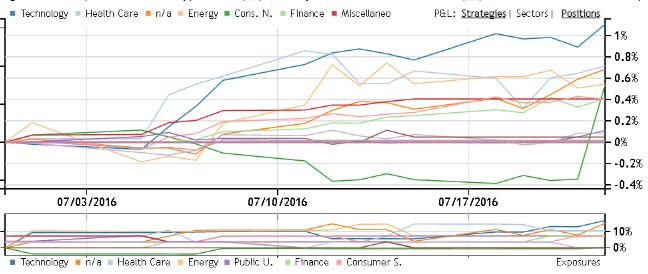

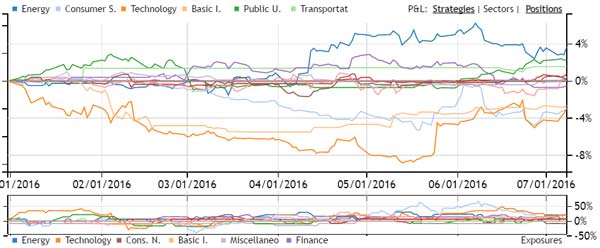

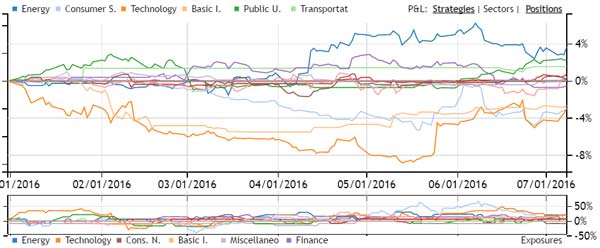

Tech Trader is back to betting on Tech, Consumer, and Energy after locking in 6% for July. It really is looking like the winters and summers are reversed this year.

zonayev (Guest) says on The Tech Trader Wall...

I am the opposite. Short Tech, health care and consumer. Betting on Financials, industrials, and Utilities. Good luck!

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Guys,

Some interesting fact for you. The best performing market neutral factor this year is 20-day RSI. The factor buys bottom 200 stocks in Russell 1000 ( oversold) and shorts top 200 most overbought stocks as determined by their 20-day RSI, rebalanced each month end. Over past 7 months the factor is up almost 17%. This is incredible performance. Basically traders market where fundamentals don't matter. Quants are trading baskets back and fourth. Until uncertainty is gone, it might be the best strategy for the rat of the year.

Sent from my iPhone

>

Some interesting fact for you. The best performing market neutral factor this year is 20-day RSI. The factor buys bottom 200 stocks in Russell 1000 ( oversold) and shorts top 200 most overbought stocks as determined by their 20-day RSI, rebalanced each month end. Over past 7 months the factor is up almost 17%. This is incredible performance. Basically traders market where fundamentals don't matter. Quants are trading baskets back and fourth. Until uncertainty is gone, it might be the best strategy for the rat of the year.

Sent from my iPhone

>

726 unique view(s)

July 22nd, 2016

pftq (Official) says on The Tech Trader Wall...

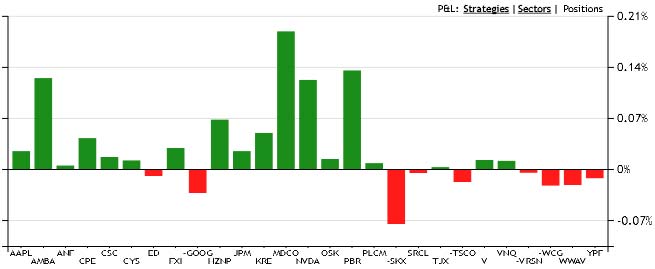

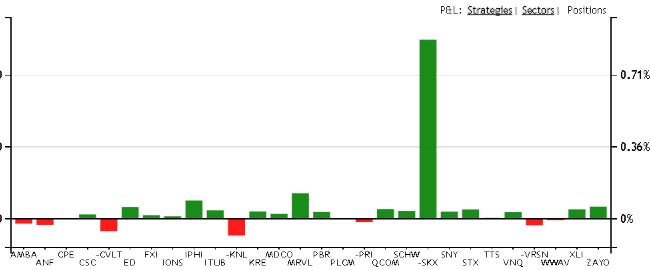

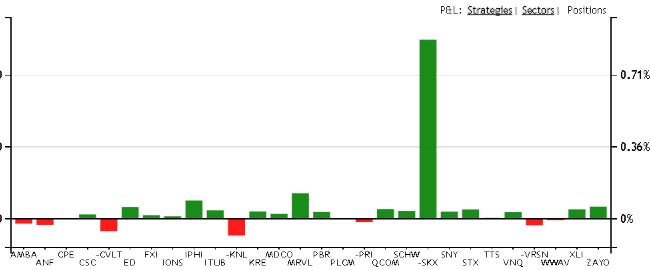

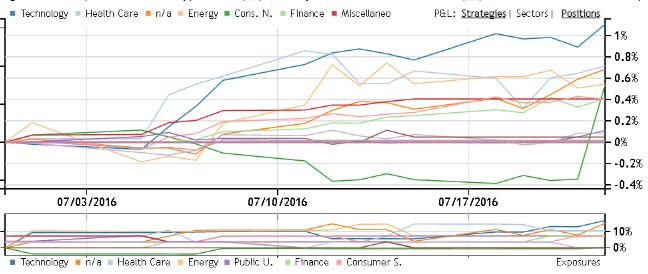

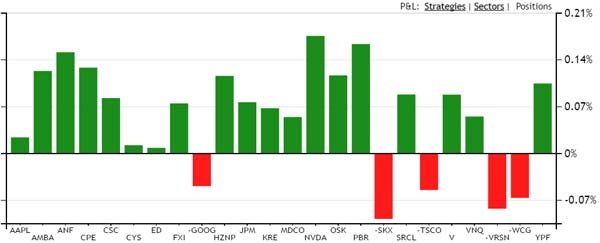

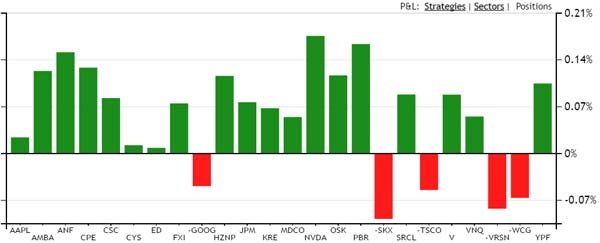

Big day for Tech Trader with short $SKX alone making over a percent for the portfolio. The rest of the portfolio even without $SKX is still outperforming $SPY at over half a percent. For July alone, Tech Trader is currently up 5%. Exposures are holding at about 90% long by 20% short with 10% cash. Sectors are a pretty neutral 10% even across the board with the top 3 being tech, healthcare, and energy, but as we saw with today, the positions are so idiosyncratic that performance can come from anywhere.

twgarry (Guest) says on The Tech Trader Wall...

great job!

733 unique view(s)

July 20th, 2016

zonayev (Guest) says on The Tech Trader Wall...

Are you guys still long TLT? Tomorrow is ECB, likely would be bearish for bonds. Draghi normally is able to lift sentiment, hence German yields, at least for one day. Then FOMC next week. You could get some relief and opportunity to exit before Fed. Post Fed I can see TLT taking another leg down ahead of BOJ. After BOJ, I have no view. Helicopter money could be the game changer. Let's see.

Sent from my iPhone

>

Sent from my iPhone

>

766 unique view(s)

July 14th, 2016

zonayev (Guest) says on The Tech Trader Wall...

I hope you exited TLT yesterday. Are you buying again today?

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

I think TLT goes lower. ECB is next week and BOJ is end of the month.

Central banks are back in a driving seat.

Gold is less certain cause selling pressure on Treasuries is weakening USD

that marginally help Gold. Gold is down over 1% now but Gold miners are

up. This can't continue unless yields fall back down.

Central banks are back in a driving seat.

Gold is less certain cause selling pressure on Treasuries is weakening USD

that marginally help Gold. Gold is down over 1% now but Gold miners are

up. This can't continue unless yields fall back down.

818 unique view(s)

July 13th, 2016

pftq (Official) says on The Tech Trader Wall...

$TLT up a percent today after yesterday's buy. Nice hedge while the market takes a breather.

zonayev (Guest) says on The Tech Trader Wall...

Nice bounce today! Good job! Equities are not fully risk off (dollar is weak) but TLT is working. Weak Oil is def helping your trade. Let me know when you exit:)

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

Final short being added for the day in $TXMD.

793 unique view(s)

July 12th, 2016

pftq (Official) says on The Tech Trader Wall...

Tech Trader buying $TLT on pullback. Reminds me of when it was long both stock and dollar index and somehow both worked out.

zonayev (Guest) says on The Tech Trader Wall...

My model is short TLT and GLD. But good luck with your trade. Your hope that risk aversion comes back.

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Note that today Utilities finally started to sell off after holding up well for some time. Higher yields would likely dislocate Utilities the most since they are overbought, have weak fundamentals and pay relatively low dividend ( based on past history).

Sent from my iPhone

>

Sent from my iPhone

>

pftq (Official) says on The Tech Trader Wall...

Thanks. Our $TLT trade should be short term just for a bounce. We are still about 70% long by 25% short excluding that.

789 unique view(s)

July 11th, 2016

pftq (Official) says on The Tech Trader Wall...

$SPY at new highs despite Brexit. Funny part is we mis-interpreted TT's long bet to be stay, but it didn't matter as it ended up outperforming anyway.

zonayev (Guest) says on The Tech Trader Wall...

The rebound from June 27th bottom is almost done. It peaks around 2-3 weeks from the bottom. I think the worst case scenario is equity and bond simultaneous sell off (risk parity unwind). Probably will be in September, while for now I like EM and beta.

Sent from my iPhone

>

Sent from my iPhone

>

729 unique view(s)

July 9th, 2016

pftq (Official) says on The Tech Trader Wall...

For those curious about the technology, we have uploaded our talk at Hyperloop last month: https://www.youtube.com/watch?v=2qcbzFyPtqM

755 unique view(s)

July 8th, 2016

pftq (Official) says on The Tech Trader Wall...

Loading up on breakout longs again, this time $BMRN, $PLCM, $TJX, $WWAV (again). Was very long into Brexit but turned out not to matter as $SPY just broke year highs. Still only 80% long by 15% short right now but managing to capture full performance of the S&P even without being fully invested. Sector exposures are still neutral though with no one sector more than 10% exposure.

TimothyB (Guest) says on The Tech Trader Wall...

charset=utf-8

Thanks! These post and Tech trader are really interesting!

>

Thanks! These post and Tech trader are really interesting!

>

763 unique view(s)

July 7th, 2016

pftq (Official) says on The Tech Trader Wall...

$WWAV another name bought out after having lots of suspicious call buying, but again already out. Tech Trader is very tight this year, hopefully loosens up soon to stop missing these.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...