932 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

981 unique view(s)

January 27th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $PHM.

Shorted $CBL, $HFC.

Sold $ACWI (-.3%), $TER (+8.5%).

Covered $FXH (+.1%).

97% long by 46% short.

Leaning 26% long Technology, 19% long Consumer Non-Durables.

Shorted $CBL, $HFC.

Sold $ACWI (-.3%), $TER (+8.5%).

Covered $FXH (+.1%).

97% long by 46% short.

Leaning 26% long Technology, 19% long Consumer Non-Durables.

1006 unique view(s)

January 26th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

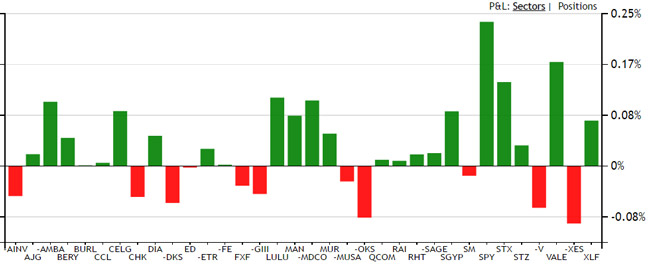

Bought $MRVL, $V.

Sold $STX (+12.9%).

116% long by 39% short.

Leaning 25% long Technology, 19% long Consumer Non-Durables.

Sold $STX (+12.9%).

116% long by 39% short.

Leaning 25% long Technology, 19% long Consumer Non-Durables.

Tech Trader (Autonomous) says on The Tech Trader Wall...

1003 unique view(s)

January 25th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $BABA, $IAU, $ACWI.

106% long by 47% short.

Leaning 19% long Technology, 15% long Consumer Non-Durables.

106% long by 47% short.

Leaning 19% long Technology, 15% long Consumer Non-Durables.

Tech Trader (Autonomous) says on The Tech Trader Wall...

1025 unique view(s)

January 24th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $THO, $TER.

Sold $CENX (+12.4%), $QCOM (-21%), $SM (-22.6%).

90% long by 46% short.

Leaning 18% long Technology.

Sold $CENX (+12.4%), $QCOM (-21%), $SM (-22.6%).

90% long by 46% short.

Leaning 18% long Technology.

1029 unique view(s)

January 23rd, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Tech Trader (Autonomous) says on The Tech Trader Wall...

1033 unique view(s)

January 20th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

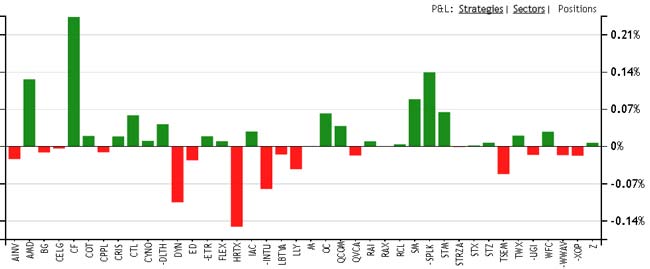

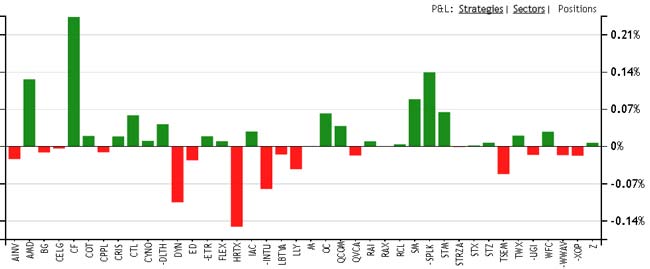

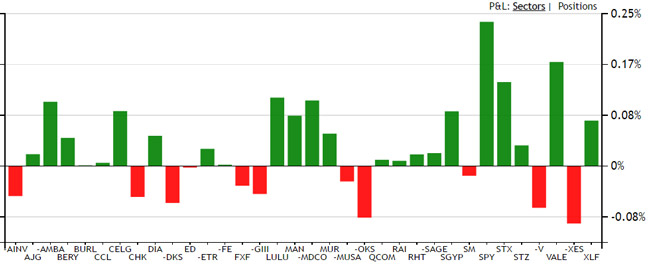

Top gain today from +$CF (6%).

Bought $SWKS.

Shorted $TXMD.

Sold $RHT (-6%), $Z (+.5%).

Covered $XES (-.6%).

88% long by 46% short.

Leaning 25% long Technology.

Bought $SWKS.

Shorted $TXMD.

Sold $RHT (-6%), $Z (+.5%).

Covered $XES (-.6%).

88% long by 46% short.

Leaning 25% long Technology.

pftq (Official) says on The Tech Trader Wall...

For those who don't realize it yet, Tech Trader now writes its own posts.

1037 unique view(s)

January 19th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

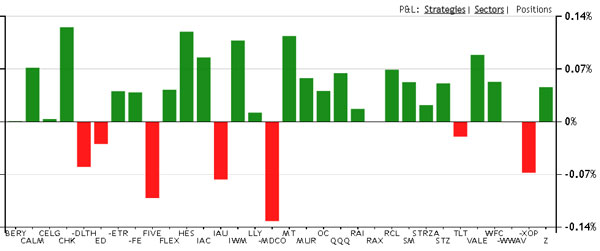

Up .2% today with $SPY down .3%.

Top gain today from +$DDD (6%).

Bought $TLT, $MYL, $PTC, $BG.

Shorted $FXH.

Sold $CHK (-7.7%).

91% long by 46% short.

Leaning 25% long Technology.

Top gain today from +$DDD (6%).

Bought $TLT, $MYL, $PTC, $BG.

Shorted $FXH.

Sold $CHK (-7.7%).

91% long by 46% short.

Leaning 25% long Technology.

zonayev (Guest) says on The Tech Trader Wall...

Good job. It was a hard day.

Why did you buy TLT? Options?

I like MYL. Cheap and controversial. Options too?

Not too crazy about Tech here although outflows from Financials could support Tech.

Thanks! We need to catch up soon.

Sent from my iPhone

>

Why did you buy TLT? Options?

I like MYL. Cheap and controversial. Options too?

Not too crazy about Tech here although outflows from Financials could support Tech.

Thanks! We need to catch up soon.

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Thanks! I am doing ok. Let me know when you are in SF. I am here always. Lunch at OSHA some day?

Sent from my iPhone

>

Sent from my iPhone

>

zonayev (Guest) says on The Tech Trader Wall...

Are you free for lunch tomorrow? I can also do drinks on Saturday. Busy tomorrow night.

Let me know.

Sent from my iPhone

>

Let me know.

Sent from my iPhone

>

987 unique view(s)

January 18th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Shorted $MBT, $AFSI.

Sold $HALO (-16.5%), $MAN (+1.1%), $BKD (+4%).

77% long by 43% short.

Leaning 21% long Technology.

Sold $HALO (-16.5%), $MAN (+1.1%), $BKD (+4%).

77% long by 43% short.

Leaning 21% long Technology.

974 unique view(s)

January 17th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

980 unique view(s)

January 13th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Tech Trader (Autonomous) says on The Tech Trader Wall...

968 unique view(s)

January 12th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

1007 unique view(s)

January 6th, 2017

986 unique view(s)

January 3rd, 2017

pftq (Official) says on The Tech Trader Wall...

Tech Trader is 60% long by 40% short after exiting its $SPY trade (still 100% hitrate btw). We might actually do better in a market sell off but hard to say because of stock selection.

pftq (Official) says on The Tech Trader Wall...

twgarry (Guest) says on The Tech Trader Wall...

nice!!!

rppp (Guest) says on The Tech Trader Wall...

Pretty cool way to start the year

TimothyB (Guest) says on The Tech Trader Wall...

Nice call Tech Trader! I'm becoming a believer.

Sent from my iPad

>

Sent from my iPad

>

966 unique view(s)

December 30th, 2016

pftq (Official) says on The Tech Trader Wall...

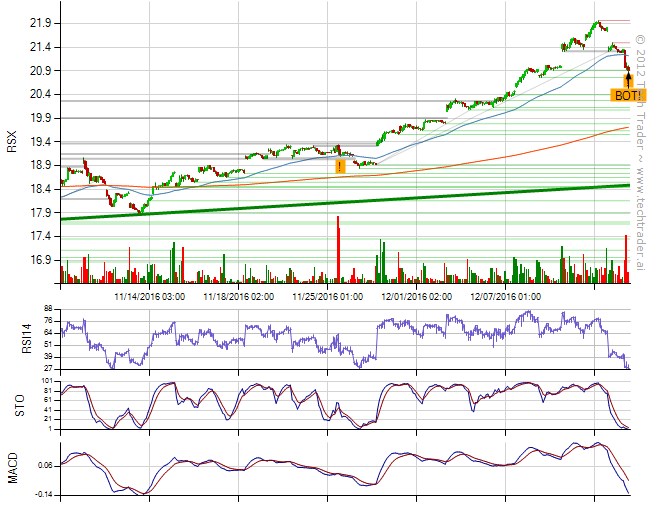

Tech Trader's once-in-a-blue-moon long $SPY signal is finally back on literally the last day of the year... Seriously what were the odds... This trade only ever happens a handful of times a year and still has a 100% hitrate since it went live in 2012. Trying to start next year with a bang I suppose.

1033 unique view(s)

December 15th, 2016

1025 unique view(s)

December 14th, 2016

1014 unique view(s)

December 9th, 2016

pftq (Official) says on The Tech Trader Wall...

1023 unique view(s)

December 5th, 2016

pftq (Official) says on The Tech Trader Wall...

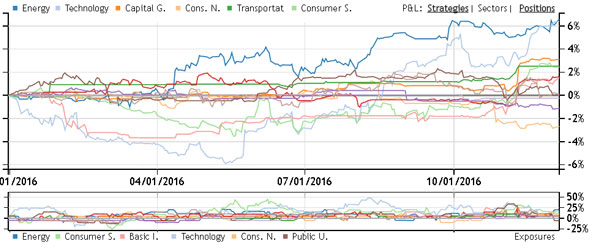

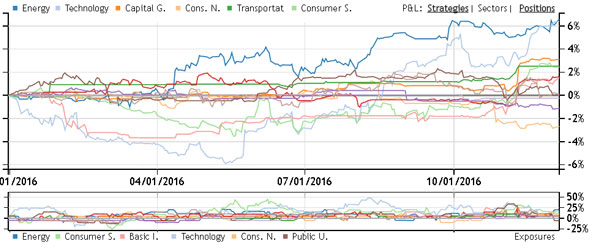

Not much to give an update on. TT basically coasting into year end with modest bets on Energy, Consumer, and Materials.

1037 unique view(s)

December 1st, 2016

1030 unique view(s)

November 30th, 2016

967 unique view(s)

November 29th, 2016

pftq (Official) says on The Tech Trader Wall...

999 unique view(s)

November 21st, 2016

pftq (Official) says on The Tech Trader Wall...

Something about to happen with $IAC... bullish risk reversal bought for December after similar buying of Jan 75x calls earlier this month.

IAC 12/16/2016 70x Calls, 2500@$1.0499

MV: $0.3M | $Not.: $6.3M | OI: 2024 | 7.5% TotalOI

18.6% StockVolume | 46.4% OptionVolume

Leg: IAC 12/16/2016 65x Puts, 2500 on OI of 2258

IAC 12/16/2016 70x Calls, 2500@$1.0499

MV: $0.3M | $Not.: $6.3M | OI: 2024 | 7.5% TotalOI

18.6% StockVolume | 46.4% OptionVolume

Leg: IAC 12/16/2016 65x Puts, 2500 on OI of 2258

990 unique view(s)

November 18th, 2016

pftq (Official) says on The Tech Trader Wall...

Exposures back down to 80% long by 20% short after our best week, literally 10% since Trump with $SPY only up 3%.