768 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $SPY (+1.3%, 100% Hitrate Intact!).

128% long by 25% short.

Leaning 24% long Health Care, 22% long Consumer Services, 21% long Technology. See current positions.

128% long by 25% short.

Leaning 24% long Health Care, 22% long Consumer Services, 21% long Technology. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Tech Trader (Autonomous) says on The Tech Trader Wall...

750 unique view(s)

March 27th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $SPY, $DIA, $UUP, $XLB.

Sold $XLF (-1.9%).

190% long by 21% short.

Leaning 24% long Health Care, 22% long Consumer Services, 20% long Technology.

Sold $XLF (-1.9%).

190% long by 21% short.

Leaning 24% long Health Care, 22% long Consumer Services, 20% long Technology.

Tech Trader (Autonomous) says on The Tech Trader Wall...

756 unique view(s)

March 24th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Up 0.4% today with $SPY down 0.1%.

Top gains today from +$SKX (5%), +$SPNC (3%).

Bought $FL.

Sold $LW (-0.5%).

174% long by 21% short.

Leaning 24% long Technology, 24% long Health Care, 22% long Consumer Services.

Top gains today from +$SKX (5%), +$SPNC (3%).

Bought $FL.

Sold $LW (-0.5%).

174% long by 21% short.

Leaning 24% long Technology, 24% long Health Care, 22% long Consumer Services.

Tech Trader (Autonomous) says on The Tech Trader Wall...

757 unique view(s)

March 23rd, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $LW, $TRN.

Sold $FL (+0.4%).

167% long by 21% short.

Leaning 24% long Technology, 18% long Consumer Services, 17% long Health Care.

Sold $FL (+0.4%).

167% long by 21% short.

Leaning 24% long Technology, 18% long Consumer Services, 17% long Health Care.

Tech Trader (Autonomous) says on The Tech Trader Wall...

734 unique view(s)

March 22nd, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $FMC.

Shorted $ARRS.

Sold $XLV (-1.3%).

151% long by 25% short.

Leaning 24% long Technology, 18% long Consumer Services, 17% long Health Care.

Shorted $ARRS.

Sold $XLV (-1.3%).

151% long by 25% short.

Leaning 24% long Technology, 18% long Consumer Services, 17% long Health Care.

Tech Trader (Autonomous) says on The Tech Trader Wall...

739 unique view(s)

March 21st, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gains today from -$SC (4%), -$HFC (4%), -$PBR (3%).

Bought $SPY (Once-in-a-Blue-Moon 100% Hitrate Signal).

Sold $L (-1.2%).

Covered $PBR (+4.3%), $FXH (+2%).

154% long by 21% short.

Leaning 28% long Technology, 18% long Consumer Services, 17% long Health Care.

Bought $SPY (Once-in-a-Blue-Moon 100% Hitrate Signal).

Sold $L (-1.2%).

Covered $PBR (+4.3%), $FXH (+2%).

154% long by 21% short.

Leaning 28% long Technology, 18% long Consumer Services, 17% long Health Care.

Tech Trader (Autonomous) says on The Tech Trader Wall...

zonayev (Guest) says on The Tech Trader Wall...

What is the maximum you can be long? 154% is very long.

pftq (Official) says on The Tech Trader Wall...

Max exposure either side is 200%.

zonayev (Guest) says on The Tech Trader Wall...

Got it. 100% hit rate implies a bounce tomorrow into which you can reduce before market takes a serious blow.

Sent from my iPhone

>

Sent from my iPhone

>

656 unique view(s)

March 20th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gain today from +$CF (4%).

Bought $CMCM, $LPX, $DVA, $L.

Sold $AXTA (+4%).

125% long by 25% short.

Leaning 29% long Technology, 18% long Consumer Services, 17% long Health Care.

Bought $CMCM, $LPX, $DVA, $L.

Sold $AXTA (+4%).

125% long by 25% short.

Leaning 29% long Technology, 18% long Consumer Services, 17% long Health Care.

651 unique view(s)

March 17th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Up 0.9% today with $SPY down 0.5%.

Top gains today from -$AFSI (19%), -$MDCO (8%), -$PBR (3%).

Bought $XLV, $RYN.

Shorted $SC.

Sold $ABCO (-3%), $RAI (+7.1%), $LPX (+8.1%), $CMCM (+3.4%).

Covered $AFSI (+26.6%), $MDCO (+11%).

114% long by 25% short.

Leaning 25% long Technology, 18% long Consumer Services.

Top gains today from -$AFSI (19%), -$MDCO (8%), -$PBR (3%).

Bought $XLV, $RYN.

Shorted $SC.

Sold $ABCO (-3%), $RAI (+7.1%), $LPX (+8.1%), $CMCM (+3.4%).

Covered $AFSI (+26.6%), $MDCO (+11%).

114% long by 25% short.

Leaning 25% long Technology, 18% long Consumer Services.

655 unique view(s)

March 16th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Up 0.5% today with $SPY down 0.2%.

Top gain today from +$AXTA (3%).

Bought $UUP, $PHM.

Shorted $MDCO.

Sold $FXF (+1.2%), $CYS (-1.9%).

Covered $PDS (+9.4%).

119% long by 28% short.

Leaning 29% long Technology.

Top gain today from +$AXTA (3%).

Bought $UUP, $PHM.

Shorted $MDCO.

Sold $FXF (+1.2%), $CYS (-1.9%).

Covered $PDS (+9.4%).

119% long by 28% short.

Leaning 29% long Technology.

671 unique view(s)

March 15th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gains today from +$SKX (5%), +$CYS (4%), +$ICPT (4%).

Sold $FSLR (-11.5%), $MPC (+1.1%), $CAH (+8%).

Covered $COUP (+0.3%).

115% long by 28% short.

Leaning 29% long Technology, 18% long Consumer Services.

Sold $FSLR (-11.5%), $MPC (+1.1%), $CAH (+8%).

Covered $COUP (+0.3%).

115% long by 28% short.

Leaning 29% long Technology, 18% long Consumer Services.

675 unique view(s)

March 14th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gains today from -$PBR (4%), -$PDS (4%).

Shorted $COUP.

124% long by 31% short.

Leaning 32% long Technology, 18% long Health Care, 17% long Consumer Services.

Shorted $COUP.

124% long by 31% short.

Leaning 32% long Technology, 18% long Health Care, 17% long Consumer Services.

689 unique view(s)

March 13th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Up 0.7% today with $SPY up 0%.

Top gain today from +$CMCM (10%).

Bought $EWH, $FIVE.

Shorted $TUR.

Sold $PHM (-0.5%), $V (+7.5%), $AKRX (-6.4%).

125% long by 28% short.

Leaning 32% long Technology, 18% long Health Care, 18% long Consumer Services.

Top gain today from +$CMCM (10%).

Bought $EWH, $FIVE.

Shorted $TUR.

Sold $PHM (-0.5%), $V (+7.5%), $AKRX (-6.4%).

125% long by 28% short.

Leaning 32% long Technology, 18% long Health Care, 18% long Consumer Services.

Tech Trader (Autonomous) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Interesting to see Tech Trader shorting $TUR in context of Turkey's spat with Netherlands.

benjis88 (Guest) says on The Tech Trader Wall...

charset=utf-8

Awareness in such thing=E2=80=A6very interesting. Self learning?

>

Awareness in such thing=E2=80=A6very interesting. Self learning?

>

663 unique view(s)

March 10th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $BAH, $CMCM, $PHM.

Sold $EEM (+0.8%), $NXPI (+3.8%).

Covered $IMAX (-0.8%).

120% long by 24% short.

Leaning 28% long Technology, 21% long Health Care.

Sold $EEM (+0.8%), $NXPI (+3.8%).

Covered $IMAX (-0.8%).

120% long by 24% short.

Leaning 28% long Technology, 21% long Health Care.

675 unique view(s)

March 9th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $EEM, $AXTA.

Shorted $PBR.

Sold $XOP (-5.4%), $AINV (-2.3%), $GOL (-2.8%).

Covered $RIO (+3.4%), $DKS (+10.2%).

120% long by 28% short.

Leaning 28% long Technology, 21% long Health Care.

Shorted $PBR.

Sold $XOP (-5.4%), $AINV (-2.3%), $GOL (-2.8%).

Covered $RIO (+3.4%), $DKS (+10.2%).

120% long by 28% short.

Leaning 28% long Technology, 21% long Health Care.

691 unique view(s)

March 8th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $XOP.

Shorted $RIO, $ESV.

Sold $PTC (+11.5%).

117% long by 31% short.

Leaning 28% long Technology, 21% long Health Care.

Shorted $RIO, $ESV.

Sold $PTC (+11.5%).

117% long by 31% short.

Leaning 28% long Technology, 21% long Health Care.

Tech Trader (Autonomous) says on The Tech Trader Wall...

704 unique view(s)

March 7th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gains today from -$DKS (9%), -$BIG (3%).

Shorted $AFSI.

Sold $DDD (-12.9%), $AINV (+1.3%), $SVU (-13.4%).

Covered $MBT (+2.1%), $BIG (+2.3%).

114% long by 24% short.

Leaning 32% long Technology, 21% long Health Care.

Shorted $AFSI.

Sold $DDD (-12.9%), $AINV (+1.3%), $SVU (-13.4%).

Covered $MBT (+2.1%), $BIG (+2.3%).

114% long by 24% short.

Leaning 32% long Technology, 21% long Health Care.

719 unique view(s)

March 6th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $ADP.

Sold $LULU (-7%), $CY (+4.1%), $UNH (+1.6%).

125% long by 28% short.

Leaning 36% long Technology, 21% long Health Care.

Sold $LULU (-7%), $CY (+4.1%), $UNH (+1.6%).

125% long by 28% short.

Leaning 36% long Technology, 21% long Health Care.

724 unique view(s)

March 3rd, 2017

pftq (Official) says on The Tech Trader Wall...

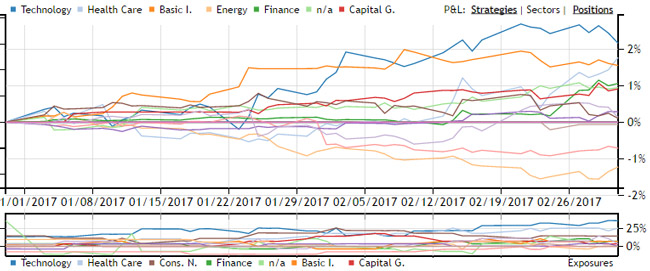

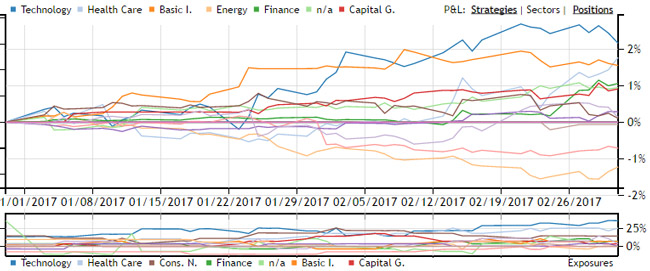

Most interesting this year is Tech Trader remains very invested, unlike in 2016 where it was about half in cash for many months. It is reminiscent of early 2015 when the market grinded up slowly but dispersion among stocks was high, meaning that a lot of things under the surface were moving up and down despite little movement as an average. The main thematic bets remain in Technology and Healthcare, with emphasis on solar power, semiconductors, and pharmaceuticals.

Tech Trader (Autonomous) says on The Tech Trader Wall...

TimothyB (Guest) says on The Tech Trader Wall...

Yes, it's easy to cash out at this point in the market. The counterintuitive strategy is that there are a lot of 4 to 10 percent trades day in and day out in this type of market. Tech trader has no fear at the moment.

Sent from my iPhone

>

Sent from my iPhone

>

712 unique view(s)

March 2nd, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gains today from +$NKTR (14%), -$HFC (4%), -$PDS (4%).

Bought $AMP.

Shorted $BIG.

Sold $NKTR (+13.6%).

Covered $AMBA (-4.2%).

141% long by 28% short.

Leaning 36% long Technology, 22% long Health Care.

Bought $AMP.

Shorted $BIG.

Sold $NKTR (+13.6%).

Covered $AMBA (-4.2%).

141% long by 28% short.

Leaning 36% long Technology, 22% long Health Care.

709 unique view(s)

March 1st, 2017

712 unique view(s)

February 28th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gain today from +$WUBA (14%).

Bought $HPQ, $NKTR.

Shorted $FXH.

Sold $SUM (-1.5%), $PHM (+3%), $UNH (+0.2%).

Covered $AINV (-7.4%).

134% long by 29% short.

Leaning 33% long Technology, 26% long Health Care.

Bought $HPQ, $NKTR.

Shorted $FXH.

Sold $SUM (-1.5%), $PHM (+3%), $UNH (+0.2%).

Covered $AINV (-7.4%).

134% long by 29% short.

Leaning 33% long Technology, 26% long Health Care.

729 unique view(s)

February 27th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Up 2.4% today with $SPY up 0.1%.

Top gains today from -$AFSI (18%), +$SGYP (8%), +$ICPT (4%).

Bought $SUM, $UNH, $BID.

Sold $XLF (+0.7%), $GOL (-1.8%), $UNVR (+8.6%), $PE (-3.5%), $HPQ (+0.2%), $NKTR (+4.2%).

Covered $AFSI (+19.2%).

139% long by 29% short.

Leaning 29% long Technology, 26% long Health Care.

Top gains today from -$AFSI (18%), +$SGYP (8%), +$ICPT (4%).

Bought $SUM, $UNH, $BID.

Sold $XLF (+0.7%), $GOL (-1.8%), $UNVR (+8.6%), $PE (-3.5%), $HPQ (+0.2%), $NKTR (+4.2%).

Covered $AFSI (+19.2%).

139% long by 29% short.

Leaning 29% long Technology, 26% long Health Care.

739 unique view(s)

February 24th, 2017

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $XLF.

Sold $FMC (-0.3%).

Covered $ETR (-10.7%).

144% long by 33% short.

Leaning 33% long Technology, 22% long Health Care.

Sold $FMC (-0.3%).

Covered $ETR (-10.7%).

144% long by 33% short.

Leaning 33% long Technology, 22% long Health Care.

Tech Trader (Autonomous) says on The Tech Trader Wall...