652 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

pftq (Official) says on The Tech Trader Wall...

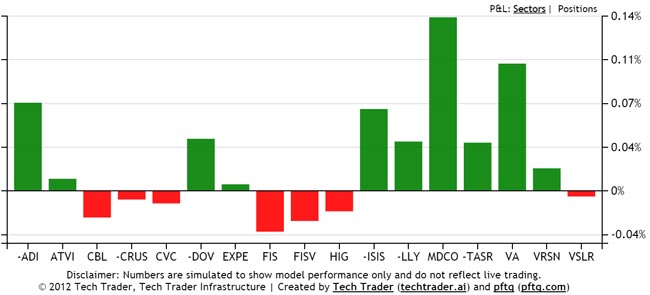

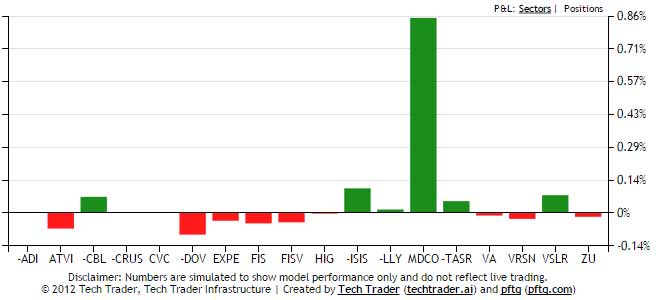

CVC up 16% after hours on acquisition deal. This is like the 5th trade this year Tech Trader got that jumped 15% overnight, with the last one being MDCO. Another great example of the idiosyncratic alpha Tech Trader captures that is more characteristic of fundamental/technical guys than quants. Should be nice padding for the big day tomorrow.

690 unique view(s)

September 10th, 2015

pftq (Official) says on The Tech Trader Wall...

lol this will change once we start traveling next week. Market goes nuts as soon as our backs are turned.

700 unique view(s)

September 9th, 2015

pftq (Official) says on The Tech Trader Wall...

Pretty hilariously awesome day. SPY opens up a percent before selling off and ending up down a percent. Tech Trader opens flat as usual but then actually gains half a percent as the market sells off, despite being net long at 30% long x 20% short. As usual, the most exciting days happen when one of us is out traveling (me this time); had the foresight this time to blindly throw on a few SPY weekly 201 puts before boarding, which are already up 100%. Getting pretty good at mastering this Fate and Irony stuff. Can't wait to see what happens when all 3 of us are out traveling on Fed Day.

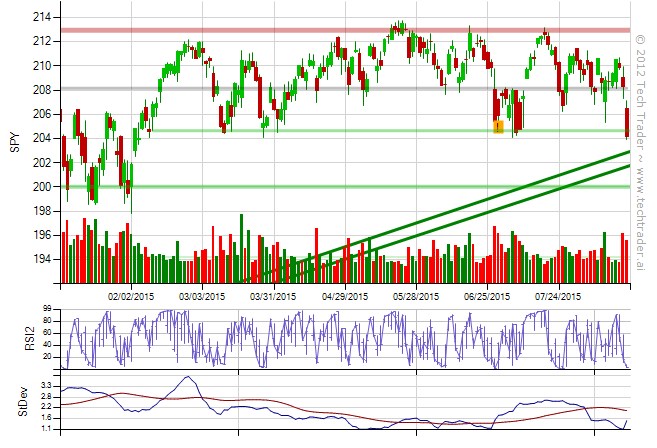

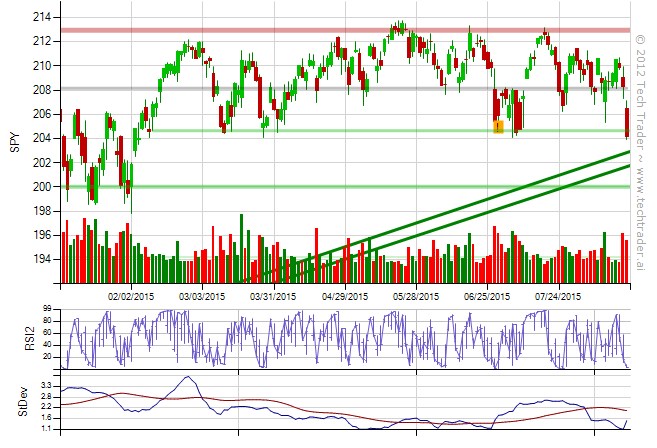

Meanwhile SPY... flopping like a dead fish as usual these past weeks.

Meanwhile SPY... flopping like a dead fish as usual these past weeks.

712 unique view(s)

September 8th, 2015

pftq (Official) says on The Tech Trader Wall...

721 unique view(s)

September 1st, 2015

pftq (Official) says on The Tech Trader Wall...

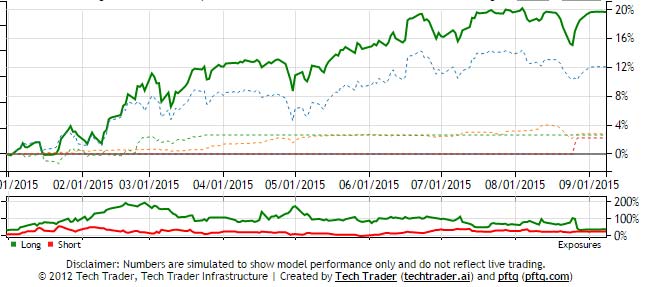

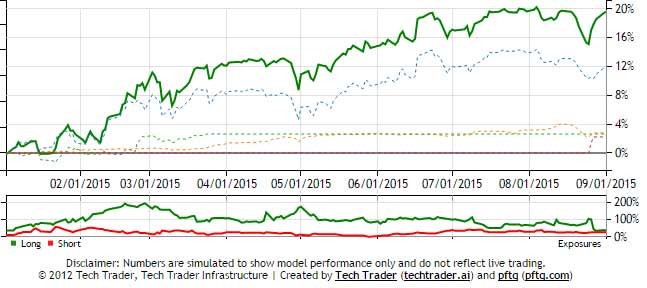

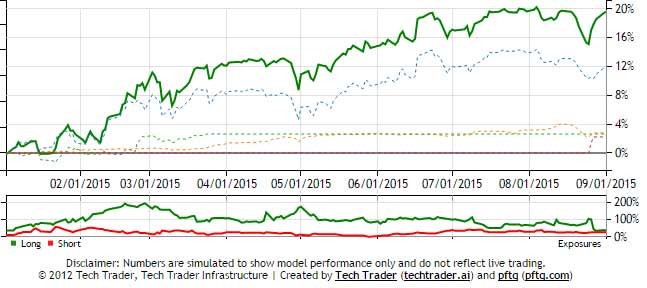

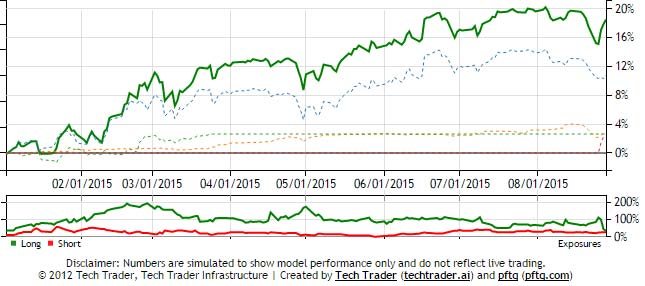

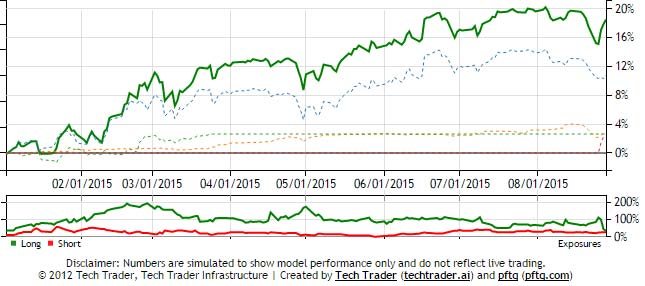

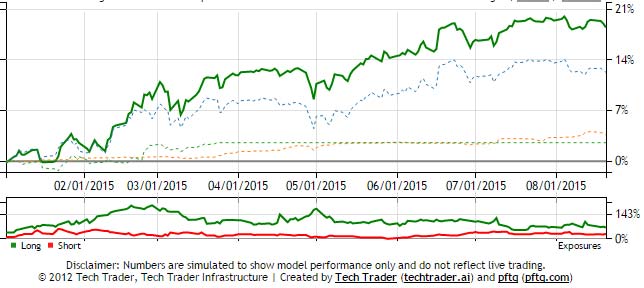

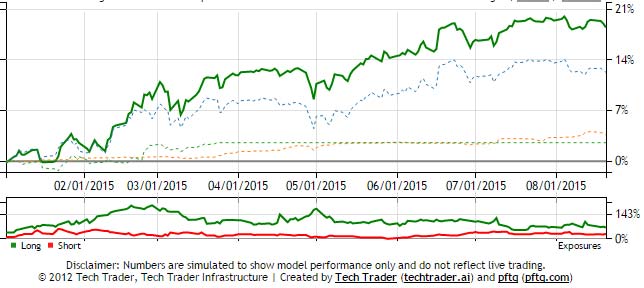

Tech Trader yet again positive for the day and at year highs, while the market is down 3% today and at year lows. Still 38% long vs 25% short, but the shorts are greatly outperforming what little the longs are down.

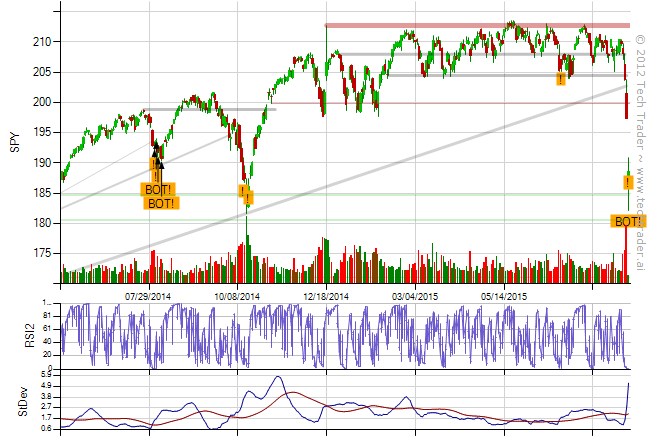

As usual, notice just how unaffected Tech Trader's performance is from SPY's whiplashing up and down. Shown in the SPY chart below is also the old Comprehensive SPY strategy's short signal from yesterday which pretty much nailed it. It's not in the core portfolio for Tech Trader, but we're having fun just manually trading weeklies in small lots around it here in our PAs. Interesting again that many of my older strategies (first Trendlines and now Comprehensive SPY strategy) are coming back to life.

As usual, notice just how unaffected Tech Trader's performance is from SPY's whiplashing up and down. Shown in the SPY chart below is also the old Comprehensive SPY strategy's short signal from yesterday which pretty much nailed it. It's not in the core portfolio for Tech Trader, but we're having fun just manually trading weeklies in small lots around it here in our PAs. Interesting again that many of my older strategies (first Trendlines and now Comprehensive SPY strategy) are coming back to life.

729 unique view(s)

August 31st, 2015

pftq (Official) says on The Tech Trader Wall...

Market grinds down another percent. Tech Trader is yet again up a percent while being only 30% long by 20% short. Idiosyncratic returns coming into play here while the market timing signals are quiet, this time from MDCO which it's held since July and is up over 20% today on.

pftq (Official) says on The Tech Trader Wall...

Hm.. the first strategy I ever wrote now wants to short SPY after selling around 213 a couple months ago. Kind of disturbing. It's made plenty of mistakes in the past though and is more of a slow moving guy, can hold for years, so it's just fun to watch more than anything. Again, just very interesting to see all my older, abandoned 2012-era strategies coming back alive now after several years of silence.

757 unique view(s)

August 28th, 2015

pftq (Official) says on The Tech Trader Wall...

The fluid rotation in Tech Trader's strategies is constantly impressive, despite having absolutely no portfolio awareness or central control (every position is independently monitored/traded). First the individual names wind down exposure in July, then Bottom 30 Min strategies recede into the background to let Trendlines short everything on the market correction, then Trendlines closes out in lock step with RSI2 SPY buying the bottom (and making an insane +700% in calls), and now that RSI2 SPY is done, the torch passes back to individual names, which again are up a solid percent while the market is flat.

pftq (Official) says on The Tech Trader Wall...

Tech Trader's overall equity-only portfolio (not including the SPY options trade, only the equity) is already back within 2% of the year highs. Exposures are also crushed to an extremely neutral 34% long by 26% short. SPY meanwhile is still down about 7% from the highs and under $200.

747 unique view(s)

August 27th, 2015

pftq (Official) says on The Tech Trader Wall...

SPY at $197! Jinxed it by exiting the $191 weekly calls yesterday ($4.5 from $1.5, +200%)... Except I still have my $197 weeklies (now $1.7 from $.3, >+500% gain) and $191 month-out ($8.5 from $3.93, >+100% gain). Take that Fate! Tech Trader is one step ahead of you. Bahaha!

Again, Tech Trader's 100% hitrate on calling SPY tops/bottoms (aka the once-in-a-blue-moon SPY signal) remains intact.

(Note the orange sell means it's thinking about but hasn't sold yet... though I'll probably at least let go of the weeklies mid-day to avoid decay)

Again, Tech Trader's 100% hitrate on calling SPY tops/bottoms (aka the once-in-a-blue-moon SPY signal) remains intact.

(Note the orange sell means it's thinking about but hasn't sold yet... though I'll probably at least let go of the weeklies mid-day to avoid decay)

pftq (Official) says on The Tech Trader Wall...

And that's the end of Tech Trader's once-in-a-blue-moon 100% hitrate SPY signal.

6.5% on the equity from $187 to $199

200% on the initial weekly 191 calls from $1.5 to $4.5

700% on the roll to weekly 197 calls from $.3 to $2.12 (my bad for selling early, would have been $3 if I let Tech Trader do this, sorry Tech Trader)

57% on the 197.5 calls Tech Trader rebought this morning in disagreement to my selling from $1.47 to $2.32

160% on the month-out 191 calls that Tech Trader bought and held the whole time as a baseline return from $3.93 to 10.23.

I think I might have to step down here after costing Tech Trader 200% on potential gains lol. There was actually a funny moment today where I literally couldn't sell because something in Tech Trader was blocking my order. Now we know why. I'm officially unneeded.

6.5% on the equity from $187 to $199

200% on the initial weekly 191 calls from $1.5 to $4.5

700% on the roll to weekly 197 calls from $.3 to $2.12 (my bad for selling early, would have been $3 if I let Tech Trader do this, sorry Tech Trader)

57% on the 197.5 calls Tech Trader rebought this morning in disagreement to my selling from $1.47 to $2.32

160% on the month-out 191 calls that Tech Trader bought and held the whole time as a baseline return from $3.93 to 10.23.

I think I might have to step down here after costing Tech Trader 200% on potential gains lol. There was actually a funny moment today where I literally couldn't sell because something in Tech Trader was blocking my order. Now we know why. I'm officially unneeded.

pftq (Official) says on The Tech Trader Wall...

Man... those 191x calls I sold yesterday... Tech Trader saw it was missing and bought it back. Only the initial base capital size, but they're already up 20%. I'm no longer in charge anymore lol

Edit: The calls it bought were 197.5x to replace the 191x. Just clarification.

Edit: The calls it bought were 197.5x to replace the 191x. Just clarification.

pftq (Official) says on The Tech Trader Wall...

Alright, out of my moonshot 197x weeklies at $2.12 (~700% from .3). I'll let Tech Trader take the reins from here with the new reset weekly calls it bought this morning and the month-out calls it's still holding.

735 unique view(s)

August 26th, 2015

pftq (Official) says on The Tech Trader Wall...

The blue moon SPY signal nailed the market bottom (from a close-to-close basis of which it operates anyway). Currently up 2% in stock, 50% in 191x weeklies, and 25% in 191x month-out calls. I totally forgot it also had a price target. Currently its target is 197 and will adjust according to market conditions. I went ahead and added some 197x weekly calls as well in case we do jump that high.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

So many people were doubting my price target as soon as I put that out, but now we're shooting straight up lol

This is the Power of Fate and Irony - letting the most ironic outcomes always be in your favor. Got me so inspired that I wrote an article on it, but hey, it's going to be the basis of my newest project so it's about time.

This is the Power of Fate and Irony - letting the most ironic outcomes always be in your favor. Got me so inspired that I wrote an article on it, but hey, it's going to be the basis of my newest project so it's about time.

pftq (Official) says on The Tech Trader Wall...

In spirit of the irony post I just wrote, I'll sell my weeklies now to ensure the success of our trade by regretting this decision tomorrow, but I'll survive this regret with my other calls lol

191x weekly calls up +200%. Still holding month out 191x up 85%.

BUT... I also have a fresh position in 197x calls at $.30 (now $1.01). Fate won't see it coming if we rally crazy tomorrow.

191x weekly calls up +200%. Still holding month out 191x up 85%.

BUT... I also have a fresh position in 197x calls at $.30 (now $1.01). Fate won't see it coming if we rally crazy tomorrow.

656 unique view(s)

August 25th, 2015

pftq (Official) says on The Tech Trader Wall...

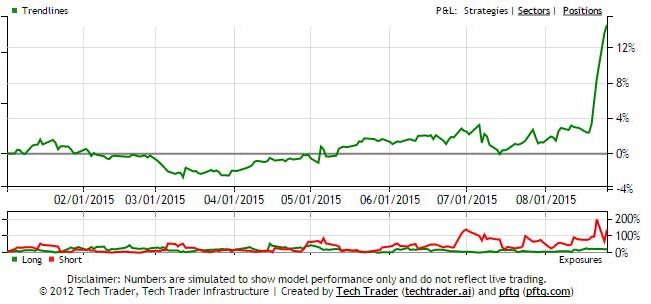

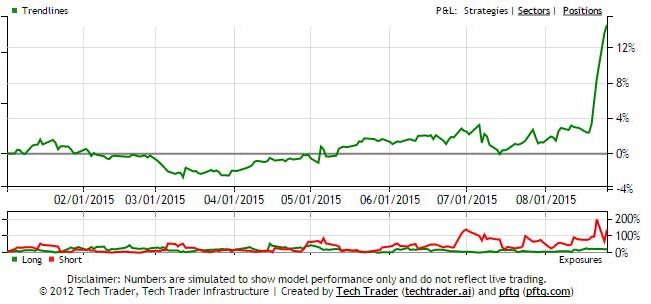

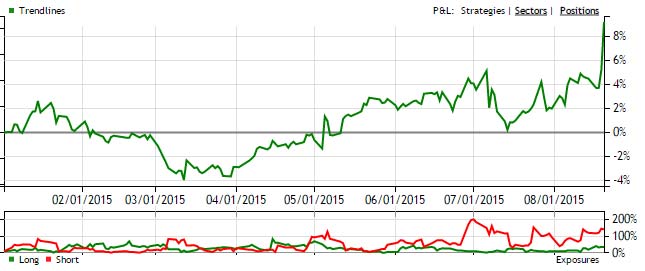

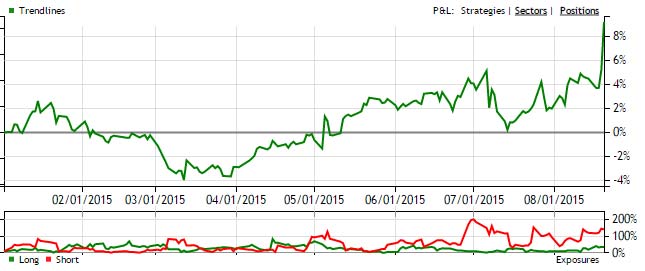

Freaking trendline breaks strategy (one of my first super-primitive ones years ago) is doing extremely well. Up 15% now for the month. Perhaps I should give the abandoned strategy a more serious look; hard to say.

pftq (Official) says on The Tech Trader Wall...

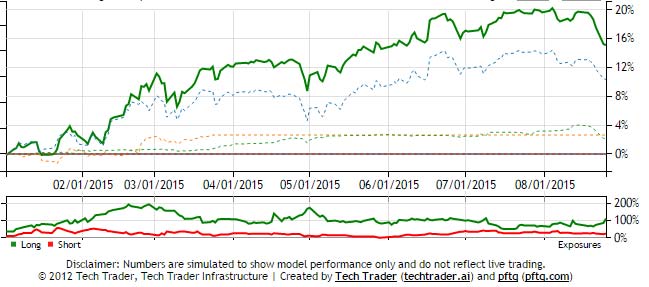

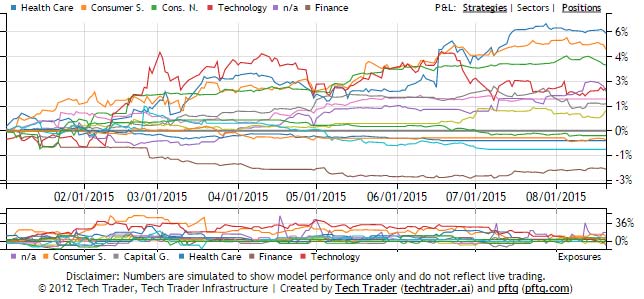

Here's a review of where things are at. Tech Trader did end up taking a hit (largely Monday) and is down 5% off the highs of 20%. Markets are off about 12% from the highs, however, and SPY is actually negative for the year now. The playbook currently is in ETFs and market timing. Positions in individual names remain very neutral as a portfolio thanks to the large exposure cutting that Tech Trader did in July. Tech Trader is getting longer on each sell off day but only in increments where it thinks might be the bottom, leaving a lot of dry powder to average down. As the market bounces, Tech Trader will scale some out, and if we go lower, it will average down again. It will do this until we get back into an uptrend of sorts where market timing signals will then recede and individual names start coming back into play.

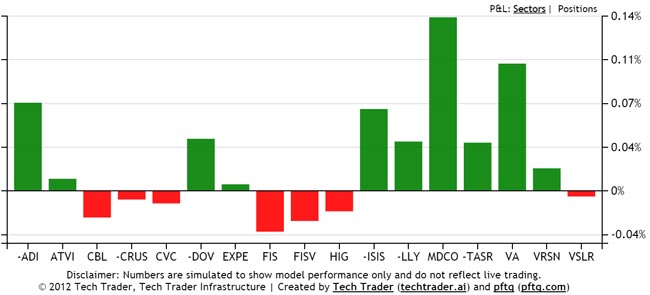

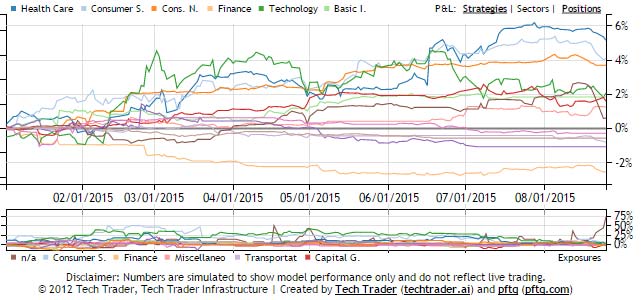

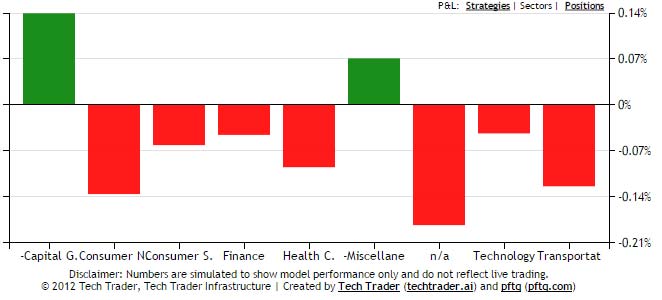

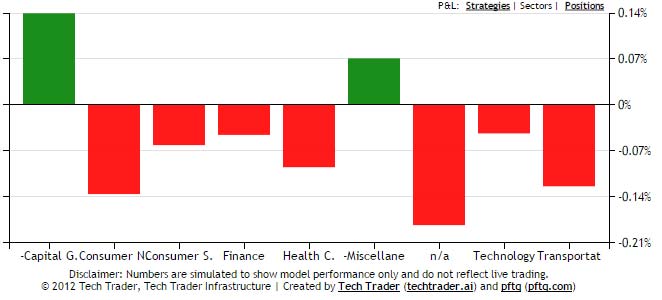

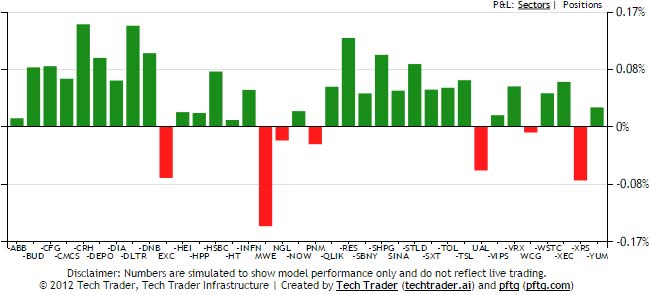

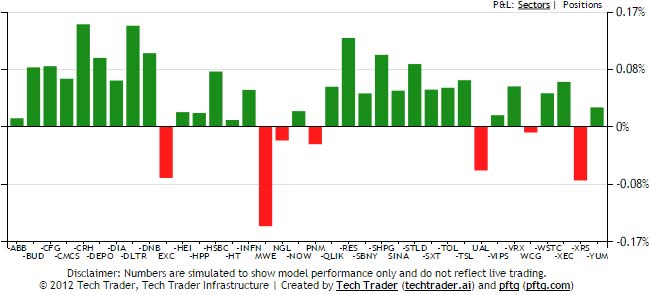

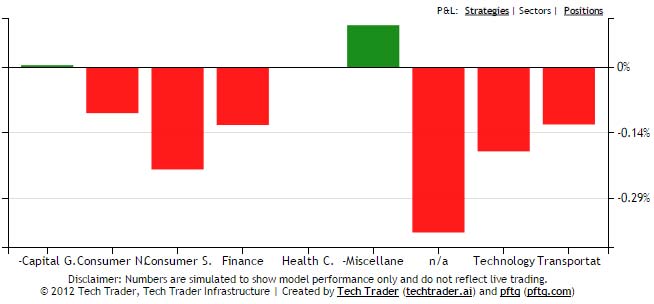

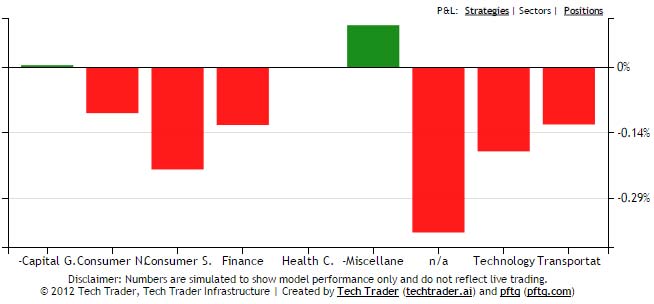

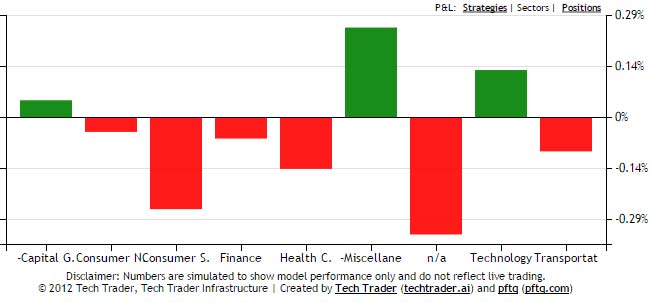

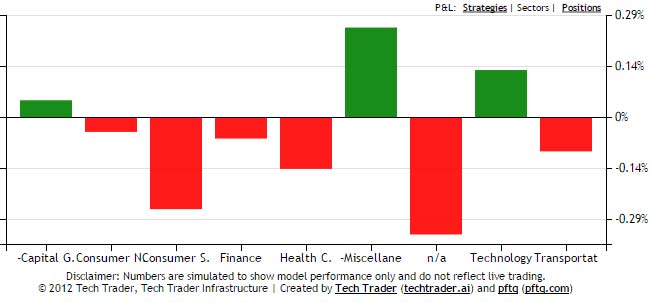

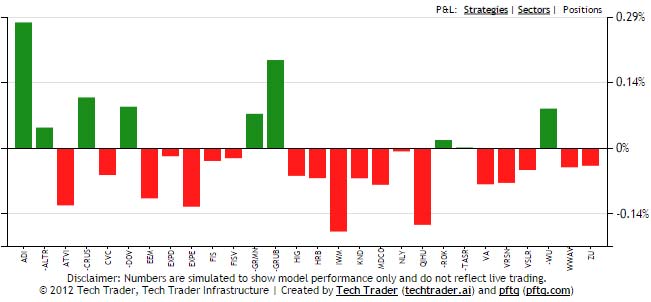

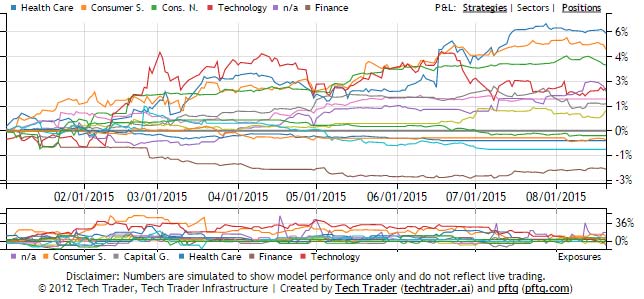

Currently it is 112% long by 24% short, with 30% of that long exposure just now being added from Tuesday's close. If you look at exposures below, you'll see that long is slowly increasing but in the sector charts, all the exposure is coming from ETFs (n/a) which is dwarfing any contribution from individual names right now.

As usual, a YTD chart of SPY for comparison always highlights how stable Tech Trader's performance is compared to the market despite being largely net long most the year (let's not kid ourselves, SPY looks like a nightmare).

Currently it is 112% long by 24% short, with 30% of that long exposure just now being added from Tuesday's close. If you look at exposures below, you'll see that long is slowly increasing but in the sector charts, all the exposure is coming from ETFs (n/a) which is dwarfing any contribution from individual names right now.

As usual, a YTD chart of SPY for comparison always highlights how stable Tech Trader's performance is compared to the market despite being largely net long most the year (let's not kid ourselves, SPY looks like a nightmare).

pftq (Official) says on The Tech Trader Wall...

Prodigal signal returns again. Let's see if it can finally hold into the close.

Update: No bottom signal per se but Tech Trader bought anyway at the very last minute at $187.41 due to the volume and severe price decline. Fingers crossed; didn't take a bottom signal to bounce from October. Very last minute (literally) buy though at the sudden plunge below $188 and only possible because Tech Trader is fully automated.

Update: No bottom signal per se but Tech Trader bought anyway at the very last minute at $187.41 due to the volume and severe price decline. Fingers crossed; didn't take a bottom signal to bounce from October. Very last minute (literally) buy though at the sudden plunge below $188 and only possible because Tech Trader is fully automated.

596 unique view(s)

August 24th, 2015

pftq (Official) says on The Tech Trader Wall...

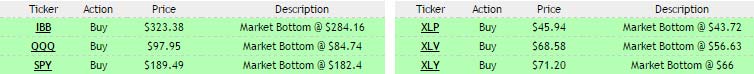

At long last, my once-in-a-blue-moon buy signal on SPY is finally here. I've been waiting all year for this.

Would wait until close, don't get hasty in case of the remote chance Tech Trader changes its mind.

(but seriously, what are the chances of filling a $10 gap in SPY by end of day?)

Update: Yet again cancelled near the close. The volume and price action is there though, so it'll probably be soon. I need to stop posting these in advance before they actually get traded. The only thing we got is a couple ETFs (XLV and SLV) intraday again. <_<

This is what a proper sell off looks like. Tech Trader wants to buy *everything*. Days like this are a beautiful example of how Tech Trader is NOT quant or conventional algo trading and definitely not mean reverting. All the other quants I know of started scaling in last week and got hit big time, unlike Tech Trader aiming for precision with technical analysis to figure out the exact bottoms (or at least pretty darn close).

Would wait until close, don't get hasty in case of the remote chance Tech Trader changes its mind.

(but seriously, what are the chances of filling a $10 gap in SPY by end of day?)

Update: Yet again cancelled near the close. The volume and price action is there though, so it'll probably be soon. I need to stop posting these in advance before they actually get traded. The only thing we got is a couple ETFs (XLV and SLV) intraday again. <_<

This is what a proper sell off looks like. Tech Trader wants to buy *everything*. Days like this are a beautiful example of how Tech Trader is NOT quant or conventional algo trading and definitely not mean reverting. All the other quants I know of started scaling in last week and got hit big time, unlike Tech Trader aiming for precision with technical analysis to figure out the exact bottoms (or at least pretty darn close).

pftq (Official) says on The Tech Trader Wall...

Lost the SPY bottom at close. Those last minutes really matter. The signal eludes me yet again. Fingers crossed we get it tomorrow.

pftq (Official) says on The Tech Trader Wall...

What's even more amazing is how all the intraday signals just sidestepped today's action and stayed quiet to let the big daily ones take over. None of this is coded. Freaking swarm intelligence at work here lol

Days like this are a beautiful example of how Tech Trader is NOT quant or conventional algo trading and definitely not mean reverting. All the other quants I know of started scaling in last week and got hit big time, unlike Tech Trader aiming for precision with technical analysis to figure out the exact bottoms (or at least pretty darn close).

Days like this are a beautiful example of how Tech Trader is NOT quant or conventional algo trading and definitely not mean reverting. All the other quants I know of started scaling in last week and got hit big time, unlike Tech Trader aiming for precision with technical analysis to figure out the exact bottoms (or at least pretty darn close).

468 unique view(s)

August 23rd, 2015

pftq (Official) says on The Tech Trader Wall...

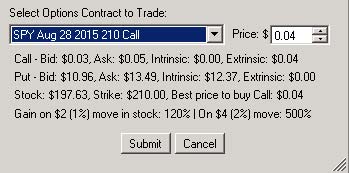

Added the strike selection logic for options to the Tech Trader interface.

(note, prices are a bit out of wack on weekends, so if this were run tomorrow morning, we would probably get a nearer-money strike)

I don't know if this is delta or some other metric/technique. It's how I've always picked my own strikes when trading options, but I never had a name for it.

(note, prices are a bit out of wack on weekends, so if this were run tomorrow morning, we would probably get a nearer-money strike)

I don't know if this is delta or some other metric/technique. It's how I've always picked my own strikes when trading options, but I never had a name for it.

427 unique view(s)

August 22nd, 2015

pftq (Official) says on The Tech Trader Wall...

It just hit me that SPY is really under $200. This is like one of the once-in-a-blue-moon opportunities to buy SPY on Tech Trader's bottom signal once it hits. That's the one we should really be waiting for and should be lining up capital to go in on. Need to wake up here and stop getting side tracked with UNG and all these other distractions.

This is the bottom signal on SPY since 2008. Super rare.

This is the bottom signal on SPY since 2008. Super rare.

419 unique view(s)

August 21st, 2015

pftq (Official) says on The Tech Trader Wall...

It's only the first half hour of the day, and Tech Trader is already outpeforming market again, down only .5% when the indicies are down 1%. Shorts like TASR (5%) helping a lot today. Added - signs to the charts to show where exposures are short.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Trendlines killing it again today up 2% on average across its names. 80% of them working in its favors and majority of them short signals. Really regret not seeing the DIA short yesterday; need to not neglect my older strategies so much.

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Very strong outperformance in Tech Trader again by the end of day. SPY is down 3% at the end of the day. Tech Trader is down only 1%, again while gradually covering shorts and adding ETF names (currently 82% long by 24% short).

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

pftq (Official) says on The Tech Trader Wall...

Saved 2 cents on XLU calls thanks to the option pricing mechanism lol

2015-08-21 08-02-48: TTFund_TDA_Options: Checking for fair value of XLU Sep 11 2015 46 Call...

2015-08-21 08-02-48: TTFund_TDA_Options: Spread too wide. Basing price on midpoint $0.37 between 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Comparing extrinsic value $0.37 on XLU Sep 11 2015 46 Call with $0.28 on XLU Sep 11 2015 46 Put...

2015-08-21 08-02-48: TTFund_TDA_Options: Buying at cheaper price $0.36 for XLU Sep 11 2015 46 Call

2015-08-21 08-02-48: TTFund_TDA_Options: Fair value check complete: Best price at $0.36 in spread of 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Checking for fair value of XLU Sep 11 2015 46 Call...

2015-08-21 08-02-48: TTFund_TDA_Options: Spread too wide. Basing price on midpoint $0.37 between 0.35x0.38

2015-08-21 08-02-48: TTFund_TDA_Options: Comparing extrinsic value $0.37 on XLU Sep 11 2015 46 Call with $0.28 on XLU Sep 11 2015 46 Put...

2015-08-21 08-02-48: TTFund_TDA_Options: Buying at cheaper price $0.36 for XLU Sep 11 2015 46 Call

2015-08-21 08-02-48: TTFund_TDA_Options: Fair value check complete: Best price at $0.36 in spread of 0.35x0.38

pftq (Official) says on The Tech Trader Wall...

XLU bouncing already. Calls that TT bought up 20% month out and 30% weekly. The bounces from the capitulation point almost always happens, but it's hard to tell for how long and how high.

297 unique view(s)

August 20th, 2015

pftq (Official) says on The Tech Trader Wall...

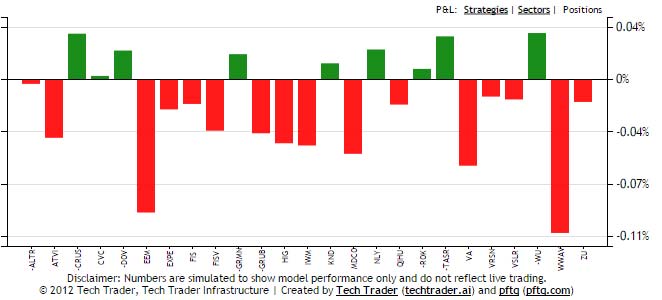

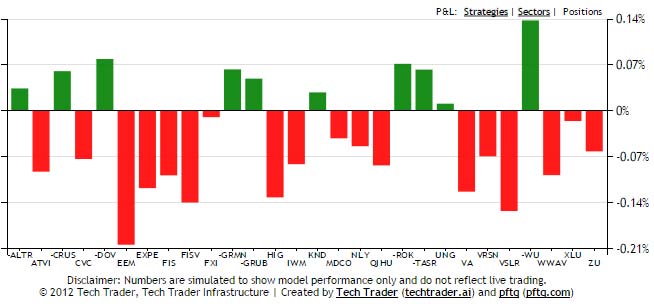

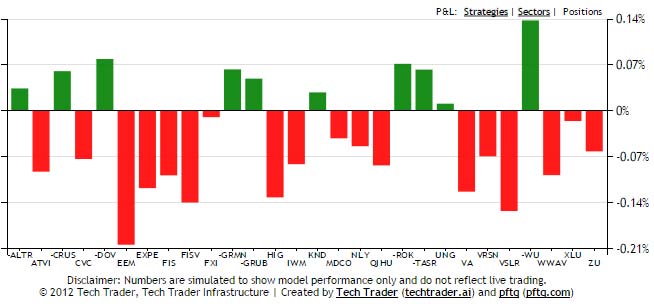

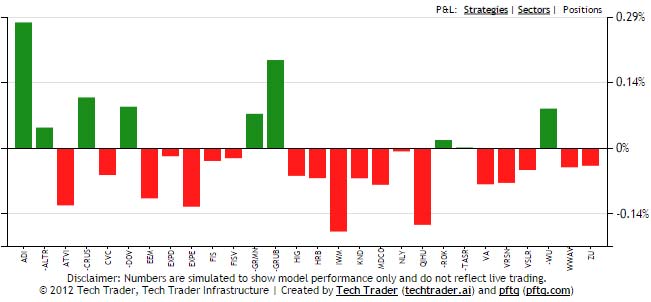

Great show of strength today for Tech Trader against the market sell off. Tech Trader in total, even with yesterday's IWM buy, is only down 0.5%. SPY is down over 2% and IWM is down almost 3%. Shorts like GRUB (5%), ADI (7%), and GRMN (2%) contributed a lot to outperformance, but it's nonetheless 40% net long, meaning longs were pretty resilient as well.

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

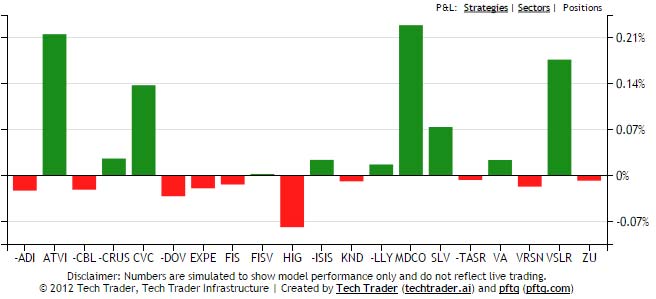

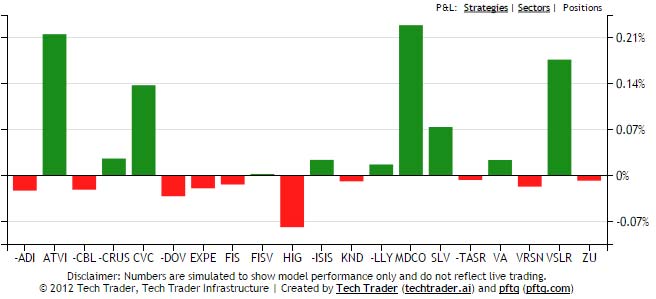

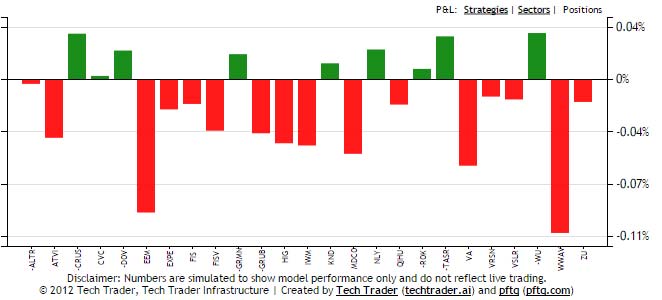

The n/a sector is ETFs, which consists of EEM and IWM collectively being down about 2% individually but affect less than .3% of the portfolio and are offset everything else. The most any individual name is losing the portfolio is no more than about .1% either.

Again, the sell off is barely a blip in Tech Trader's P&L while you can see SPY for the YTD time frame being very volatile.

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

The n/a sector is ETFs, which consists of EEM and IWM collectively being down about 2% individually but affect less than .3% of the portfolio and are offset everything else. The most any individual name is losing the portfolio is no more than about .1% either.

Again, the sell off is barely a blip in Tech Trader's P&L while you can see SPY for the YTD time frame being very volatile.

pftq (Official) says on The Tech Trader Wall...

A lesser talked about strategy for Trendline Breaks is also killing it this week. This is the one that a friend and I used to trade around manually because it doesn't have automated exits. The paper portfolio just gets out on the first day of gain or after 1 stdev loss. It's a good gauge for where things are at though, especially if it's >100% short and making 4% in a few days.

pftq (Official) says on The Tech Trader Wall...

Updated the last post to include percentages on the column charts and a second chart showing how no single name lost more than .1% of the portfolio.

pftq (Official) says on The Tech Trader Wall...

What's interesting to note is that Tech Trader isn't buying the dip today; no bottom or RSI signals on the major indices. There was one yesterday and a leftover from last week, but not the usual 3-5 cluster or more with aggressive averaging down. Again, exposures are at year lows of 65% long vs 28% short.

234 unique view(s)

August 19th, 2015

pftq (Official) says on The Tech Trader Wall...