76 unique view(s)

Updates by Tech Trader, a fully autonomous trading system with no human intervention.

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Receive updates via Twitter @TechTraderAI or StockTwits @TechTraderAI.

Charts and analysis also available for: Stocks, Cryptocurrencies

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $VG.

Covered $MGY (+4.5%).

103% long by 5% short. 27% long Health Care, 19% long Technology, 14% long Finance, 14% long Consumer Services, 8% long Energy, 7% long Consumer Durables, 7% long Public Utilities, 5% short Capital Goods. See current positions.

Covered $MGY (+4.5%).

103% long by 5% short. 27% long Health Care, 19% long Technology, 14% long Finance, 14% long Consumer Services, 8% long Energy, 7% long Consumer Durables, 7% long Public Utilities, 5% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $CYH, $PAGP.

Shorted $DDD, $NIO.

Sold $IHRT (-0.6%), $VG (+0.1%), $BHF (-3.3%), $HWC (-0.6%), $KEX (-1.1%), $NEWR (-9.7%), $UMC (-9.6%), $VNET (-11.7%).

56% long by 16% short. 34% long Health Care, 9% short Capital Goods, 8% long Energy, 7% long Consumer Durables, 6% short Technology. See current positions.

Shorted $DDD, $NIO.

Sold $IHRT (-0.6%), $VG (+0.1%), $BHF (-3.3%), $HWC (-0.6%), $KEX (-1.1%), $NEWR (-9.7%), $UMC (-9.6%), $VNET (-11.7%).

56% long by 16% short. 34% long Health Care, 9% short Capital Goods, 8% long Energy, 7% long Consumer Durables, 6% short Technology. See current positions.

65 unique view(s)

March 3rd, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $CPLG (+11.2%).

99% long by 12% short. 27% long Health Care, 21% long Technology, 21% long Consumer Services, 8% long Consumer Durables, 7% long Finance, 6% short Capital Goods. See current positions.

99% long by 12% short. 27% long Health Care, 21% long Technology, 21% long Consumer Services, 8% long Consumer Durables, 7% long Finance, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $BHF.

107% long by 12% short. 28% long Health Care, 21% long Technology, 21% long Consumer Services, 15% long Finance, 8% long Consumer Durables, 6% short Capital Goods. See current positions.

107% long by 12% short. 28% long Health Care, 21% long Technology, 21% long Consumer Services, 15% long Finance, 8% long Consumer Durables, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $CNQ.

Sold $STKL (-10.9%).

105% long by 12% short. 28% long Health Care, 20% long Technology, 14% long Finance, 14% long Consumer Services, 8% long Energy, 7% long Consumer Durables, 5% short Capital Goods. See current positions.

Sold $STKL (-10.9%).

105% long by 12% short. 28% long Health Care, 20% long Technology, 14% long Finance, 14% long Consumer Services, 8% long Energy, 7% long Consumer Durables, 5% short Capital Goods. See current positions.

71 unique view(s)

March 2nd, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $IHRT.

124% long by 12% short. 35% long Health Care, 30% long Consumer Services, 22% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

124% long by 12% short. 35% long Health Care, 30% long Consumer Services, 22% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $NBIX (-10.6%).

117% long by 13% short. 30% long Consumer Services, 29% long Health Care, 22% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

117% long by 13% short. 30% long Consumer Services, 29% long Health Care, 22% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $KTB (+5%).

109% long by 12% short. 30% long Consumer Services, 28% long Health Care, 21% long Technology, 8% long Consumer Durables, 7% long Finance, 6% short Capital Goods. See current positions.

109% long by 12% short. 30% long Consumer Services, 28% long Health Care, 21% long Technology, 8% long Consumer Durables, 7% long Finance, 6% short Capital Goods. See current positions.

69 unique view(s)

March 1st, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $STKL, $HWC.

119% long by 12% short. 43% long Health Care, 24% long Consumer Services, 15% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

119% long by 12% short. 43% long Health Care, 24% long Consumer Services, 15% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $ADVM (-0.2%).

112% long by 13% short. 36% long Health Care, 24% long Consumer Services, 15% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

112% long by 13% short. 36% long Health Care, 24% long Consumer Services, 15% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gains today from long $SFT (+9%), long $PAGP (+6%), long $VNET (+6%).

Bought $NEWR.

118% long by 13% short. 36% long Health Care, 24% long Consumer Services, 22% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

Bought $NEWR.

118% long by 13% short. 36% long Health Care, 24% long Consumer Services, 22% long Technology, 8% long Consumer Durables, 7% long Consumer Non-Durables, 7% long Finance, 6% short Capital Goods. See current positions.

125 unique view(s)

February 25th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

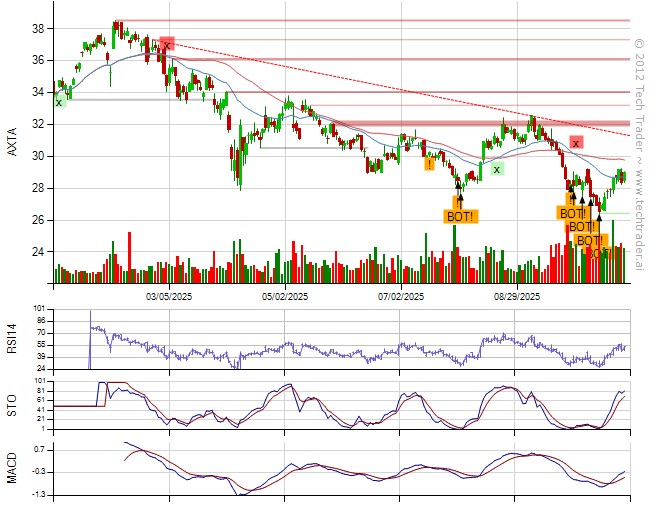

Sold $AXTA (-1.9%), $K (-4.5%), $KDP (-1.4%), $UFS (+6.5%).

104% long by 12% short. 43% long Health Care, 16% long Consumer Services, 14% long Technology, 7% long Consumer Durables, 7% long Consumer Non-Durables, 6% short Capital Goods. See current positions.

104% long by 12% short. 43% long Health Care, 16% long Consumer Services, 14% long Technology, 7% long Consumer Durables, 7% long Consumer Non-Durables, 6% short Capital Goods. See current positions.

91 unique view(s)

February 24th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $PAGP.

Shorted $SPCX.

134% long by 21% short. 43% long Health Care, 21% long Consumer Non-Durables, 17% long Consumer Services, 15% long Technology, 14% long Basic Industries, 8% long Consumer Durables, 8% short Finance, 7% long Energy, 6% short Capital Goods. See current positions.

Shorted $SPCX.

134% long by 21% short. 43% long Health Care, 21% long Consumer Non-Durables, 17% long Consumer Services, 15% long Technology, 14% long Basic Industries, 8% long Consumer Durables, 8% short Finance, 7% long Energy, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $QURE.

Shorted $MGY.

Sold $NGM (-5.3%).

Covered $TD (-9.8%), $SPCX (+0.7%).

135% long by 13% short. 44% long Health Care, 21% long Consumer Non-Durables, 17% long Consumer Services, 15% long Basic Industries, 15% long Technology, 8% long Consumer Durables, 6% short Capital Goods. See current positions.

Shorted $MGY.

Sold $NGM (-5.3%).

Covered $TD (-9.8%), $SPCX (+0.7%).

135% long by 13% short. 44% long Health Care, 21% long Consumer Non-Durables, 17% long Consumer Services, 15% long Basic Industries, 15% long Technology, 8% long Consumer Durables, 6% short Capital Goods. See current positions.

65 unique view(s)

February 23rd, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

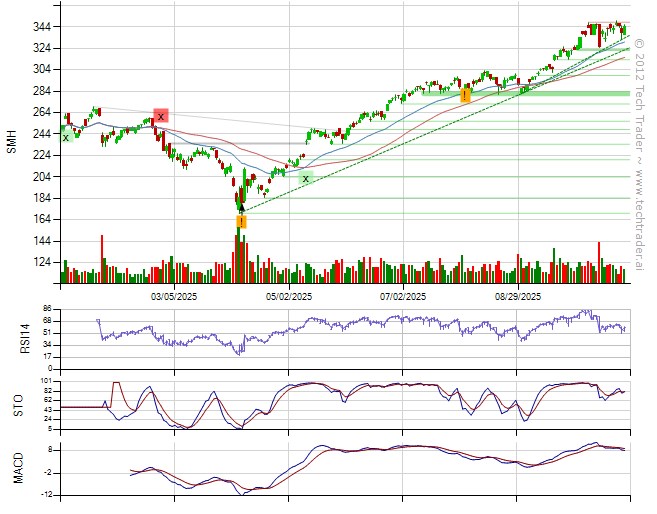

Bought $SMH, $XBI, $IBB.

124% long by 13% short. 34% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 7% long Technology, 5% short Capital Goods. See current positions.

124% long by 13% short. 34% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 7% long Technology, 5% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

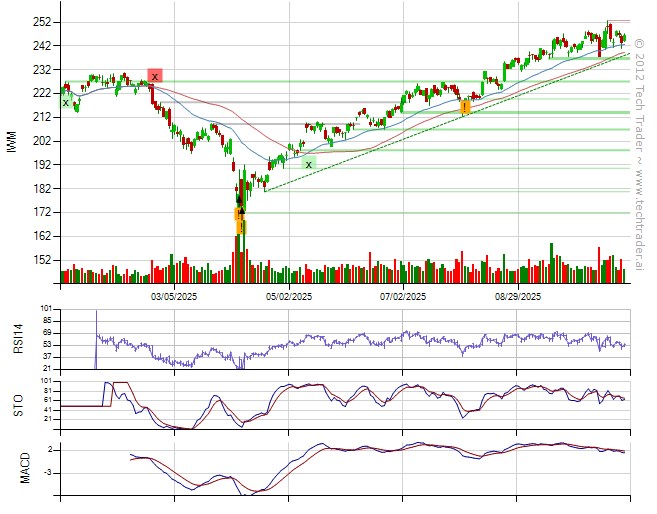

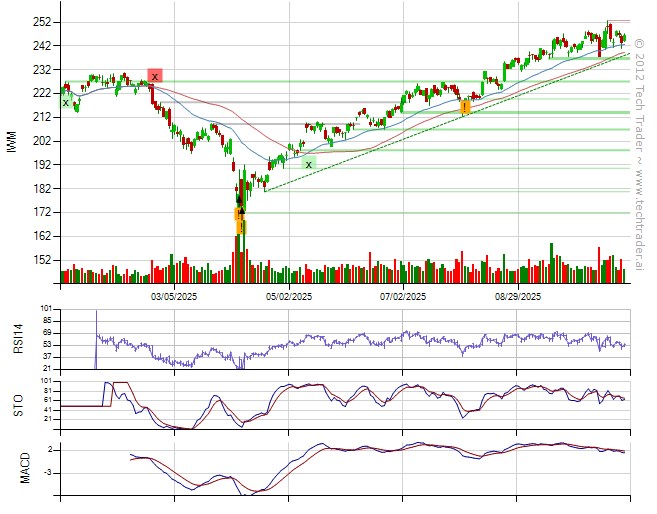

Bought $IWM.

131% long by 13% short. 35% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 7% long Technology, 6% short Capital Goods. See current positions.

131% long by 13% short. 35% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 7% long Technology, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $IWM (+1.1%).

124% long by 13% short. 34% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 7% long Technology, 6% short Capital Goods. See current positions.

124% long by 13% short. 34% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 7% long Technology, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $VNET.

Sold $SMH (+1.8%), $XBI (+1.5%), $IBB (+1.4%).

110% long by 13% short. 35% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 15% long Technology, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 6% short Capital Goods. See current positions.

Sold $SMH (+1.8%), $XBI (+1.5%), $IBB (+1.4%).

110% long by 13% short. 35% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 15% long Technology, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $AXTA, $ADVM.

124% long by 13% short. 41% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 15% long Technology, 14% long Basic Industries, 8% long Consumer Durables, 8% short Finance, 6% short Capital Goods. See current positions.

124% long by 13% short. 41% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 15% long Technology, 14% long Basic Industries, 8% long Consumer Durables, 8% short Finance, 6% short Capital Goods. See current positions.

69 unique view(s)

February 22nd, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $KDP, $KEX.

117% long by 14% short. 55% long Health Care, 16% long Consumer Services, 14% long Consumer Non-Durables, 9% long Consumer Durables, 8% long Technology, 8% short Finance, 7% long Basic Industries, 6% short Capital Goods. See current positions.

117% long by 14% short. 55% long Health Care, 16% long Consumer Services, 14% long Consumer Non-Durables, 9% long Consumer Durables, 8% long Technology, 8% short Finance, 7% long Basic Industries, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $KTB.

124% long by 14% short. 55% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 9% long Consumer Durables, 8% long Technology, 8% short Finance, 7% long Basic Industries, 6% short Capital Goods. See current positions.

124% long by 14% short. 55% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 9% long Consumer Durables, 8% long Technology, 8% short Finance, 7% long Basic Industries, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Shorted $VIR.

Sold $BCEL (+0.1%), $OTIC (-37.4%), $ALLK (-9.2%).

104% long by 20% short. 28% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 8% long Technology, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 6% short Capital Goods. See current positions.

Sold $BCEL (+0.1%), $OTIC (-37.4%), $ALLK (-9.2%).

104% long by 20% short. 28% long Health Care, 21% long Consumer Non-Durables, 16% long Consumer Services, 8% long Technology, 8% long Consumer Durables, 8% short Finance, 7% long Basic Industries, 6% short Capital Goods. See current positions.

104 unique view(s)

February 19th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Up 1% today with $SPY down 0.3%.

Top gains from long $FLY (+8%), long $RLMD (+6%).

Bought $BCEL.

Sold $AMX (-9.5%).

Covered $PFGC (-10.6%).

105% long by 14% short. 58% long Health Care, 9% long Consumer Durables, 8% long Technology, 8% long Consumer Services, 7% long Consumer Non-Durables, 7% long Basic Industries, 7% short Finance, 6% short Capital Goods. See current positions.

Top gains from long $FLY (+8%), long $RLMD (+6%).

Bought $BCEL.

Sold $AMX (-9.5%).

Covered $PFGC (-10.6%).

105% long by 14% short. 58% long Health Care, 9% long Consumer Durables, 8% long Technology, 8% long Consumer Services, 7% long Consumer Non-Durables, 7% long Basic Industries, 7% short Finance, 6% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $SFT.

105% long by 22% short. 51% long Health Care, 9% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% long Basic Industries, 7% short Finance, 6% short Capital Goods. See current positions.

105% long by 22% short. 51% long Health Care, 9% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% long Basic Industries, 7% short Finance, 6% short Capital Goods. See current positions.

88 unique view(s)

February 18th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $FLY.

95% long by 21% short. 51% long Health Care, 8% long Technology, 8% long Consumer Services, 7% long Basic Industries, 7% long Public Utilities, 7% short Finance, 6% short Capital Goods. See current positions.

95% long by 21% short. 51% long Health Care, 8% long Technology, 8% long Consumer Services, 7% long Basic Industries, 7% long Public Utilities, 7% short Finance, 6% short Capital Goods. See current positions.

94 unique view(s)

February 17th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gain today from long $OTIC (+9%).

88% long by 21% short. 52% long Health Care, 8% long Technology, 8% long Consumer Services, 7% long Basic Industries, 7% long Public Utilities, 7% short Finance, 6% short Capital Goods. See current positions.

88% long by 21% short. 52% long Health Care, 8% long Technology, 8% long Consumer Services, 7% long Basic Industries, 7% long Public Utilities, 7% short Finance, 6% short Capital Goods. See current positions.

100 unique view(s)

February 16th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $PETQ.

112% long by 21% short. 51% long Health Care, 16% long Technology, 9% long Consumer Durables, 8% long Consumer Services, 7% long Basic Industries, 7% long Transportation, 7% long Public Utilities, 7% short Capital Goods, 7% short Finance. See current positions.

112% long by 21% short. 51% long Health Care, 16% long Technology, 9% long Consumer Durables, 8% long Consumer Services, 7% long Basic Industries, 7% long Transportation, 7% long Public Utilities, 7% short Capital Goods, 7% short Finance. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $AAWW (-2.8%), $CLGX (+14.8%), $SFT (+19.1%).

88% long by 22% short. 51% long Health Care, 8% long Technology, 8% long Consumer Services, 7% long Basic Industries, 7% long Public Utilities, 7% short Finance, 6% short Capital Goods. See current positions.

88% long by 22% short. 51% long Health Care, 8% long Technology, 8% long Consumer Services, 7% long Basic Industries, 7% long Public Utilities, 7% short Finance, 6% short Capital Goods. See current positions.

108 unique view(s)

February 12th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $AAWW, $UFS, $NBIX.

111% long by 29% short. 51% long Health Care, 8% long Technology, 8% long Consumer Durables, 8% long Consumer Services, 7% long Basic Industries, 7% long Transportation, 7% long Public Utilities, 7% short Capital Goods, 7% short Finance. See current positions.

111% long by 29% short. 51% long Health Care, 8% long Technology, 8% long Consumer Durables, 8% long Consumer Services, 7% long Basic Industries, 7% long Transportation, 7% long Public Utilities, 7% short Capital Goods, 7% short Finance. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gain today from long $SFT (+4%).

Sold $PETQ (+0.4%).

Covered $CDLX (-9.5%).

104% long by 21% short. 44% long Health Care, 16% long Technology, 8% long Consumer Durables, 8% long Consumer Services, 7% long Basic Industries, 7% long Transportation, 7% long Public Utilities, 7% short Capital Goods, 7% short Finance. See current positions.

Sold $PETQ (+0.4%).

Covered $CDLX (-9.5%).

104% long by 21% short. 44% long Health Care, 16% long Technology, 8% long Consumer Durables, 8% long Consumer Services, 7% long Basic Industries, 7% long Transportation, 7% long Public Utilities, 7% short Capital Goods, 7% short Finance. See current positions.

129 unique view(s)

February 11th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $NGM.

82% long by 29% short. 37% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

82% long by 29% short. 37% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $PETQ.

89% long by 29% short. 44% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

89% long by 29% short. 44% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

113 unique view(s)

February 10th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Top gain today from short $TSLA (+5%).

Bought $CPLG.

Sold $ARCB (+6.6%).

75% long by 29% short. 30% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

Bought $CPLG.

Sold $ARCB (+6.6%).

75% long by 29% short. 30% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

99 unique view(s)

February 9th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $CNR (-3.9%).

76% long by 30% short. 31% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

76% long by 30% short. 31% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $ARCB.

Sold $CPLG (+10.3%).

75% long by 30% short. 31% long Health Care, 8% long Consumer Durables, 8% long Technology, 7% long Transportation, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

Sold $CPLG (+10.3%).

75% long by 30% short. 31% long Health Care, 8% long Consumer Durables, 8% long Technology, 7% long Transportation, 7% long Public Utilities, 7% short Finance, 7% short Capital Goods. See current positions.

107 unique view(s)

February 8th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Up 2.2% today with $SPY up 0.6%.

Top gains from long $SFT (+19%), long $CNR (+7%), long $UMC (+4%).

Sold $ERIE (+5.8%).

82% long by 30% short. 31% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance. See current positions.

Top gains from long $SFT (+19%), long $CNR (+7%), long $UMC (+4%).

Sold $ERIE (+5.8%).

82% long by 30% short. 31% long Health Care, 8% long Consumer Durables, 8% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% short Finance. See current positions.

214 unique view(s)

February 4th, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Up 2.3% today with $SPY up 1%.

Sold $WMS (+16.4%), $RVMD (+21.9%).

86% long by 29% short. 30% long Health Care, 8% long Consumer Services, 8% long Technology, 7% long Consumer Durables, 7% long Public Utilities. See current positions.

Sold $WMS (+16.4%), $RVMD (+21.9%).

86% long by 29% short. 30% long Health Care, 8% long Consumer Services, 8% long Technology, 7% long Consumer Durables, 7% long Public Utilities. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $OTIC.

Sold $ANGI (-4.5%).

102% long by 29% short. 38% long Health Care, 8% long Capital Goods, 8% long Consumer Services, 8% long Technology, 7% long Consumer Durables, 7% long Public Utilities. See current positions.

Sold $ANGI (-4.5%).

102% long by 29% short. 38% long Health Care, 8% long Capital Goods, 8% long Consumer Services, 8% long Technology, 7% long Consumer Durables, 7% long Public Utilities. See current positions.

119 unique view(s)

February 3rd, 2021

Tech Trader (Autonomous) says on The Tech Trader Wall...

Bought $UMC.

Sold $TENB (-11.6%).

110% long by 29% short. 40% long Health Care, 15% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% long Capital Goods, 7% long Consumer Durables. See current positions.

Sold $TENB (-11.6%).

110% long by 29% short. 40% long Health Care, 15% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% long Capital Goods, 7% long Consumer Durables. See current positions.

Tech Trader (Autonomous) says on The Tech Trader Wall...

Sold $FREQ (+6.3%).

100% long by 29% short. 30% long Health Care, 15% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% long Capital Goods, 7% long Consumer Durables. See current positions.

100% long by 29% short. 30% long Health Care, 15% long Consumer Services, 8% long Technology, 7% long Public Utilities, 7% long Capital Goods, 7% long Consumer Durables. See current positions.